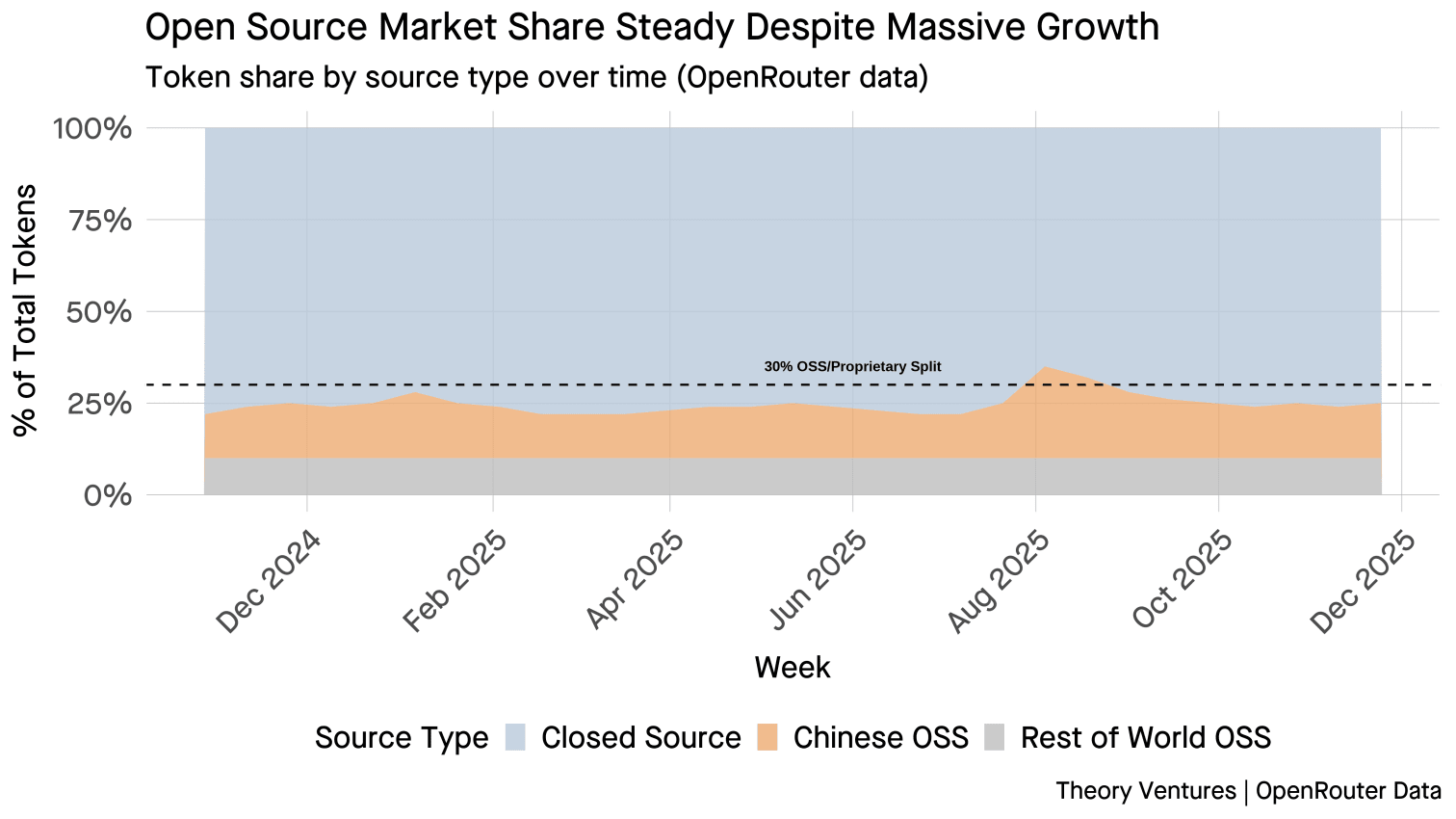

Despite open-source AI models being 10-100x cheaper, proprietary providers haven’t lost pricing power. OpenRouter’s data reveals a market splitting in two.

Over the last year, open-source models’ market share has remained stable around 22-25%, briefly spiking to 35% during the explosive growth of Chinese models in mid-2025 before settling back down.

The weak price elasticity indicates that even drastic cost differences do not fully shift demand; proprietary providers retain pricing power for mission-critical applications, while open ecosystems absorb volume from cost-sensitive users.

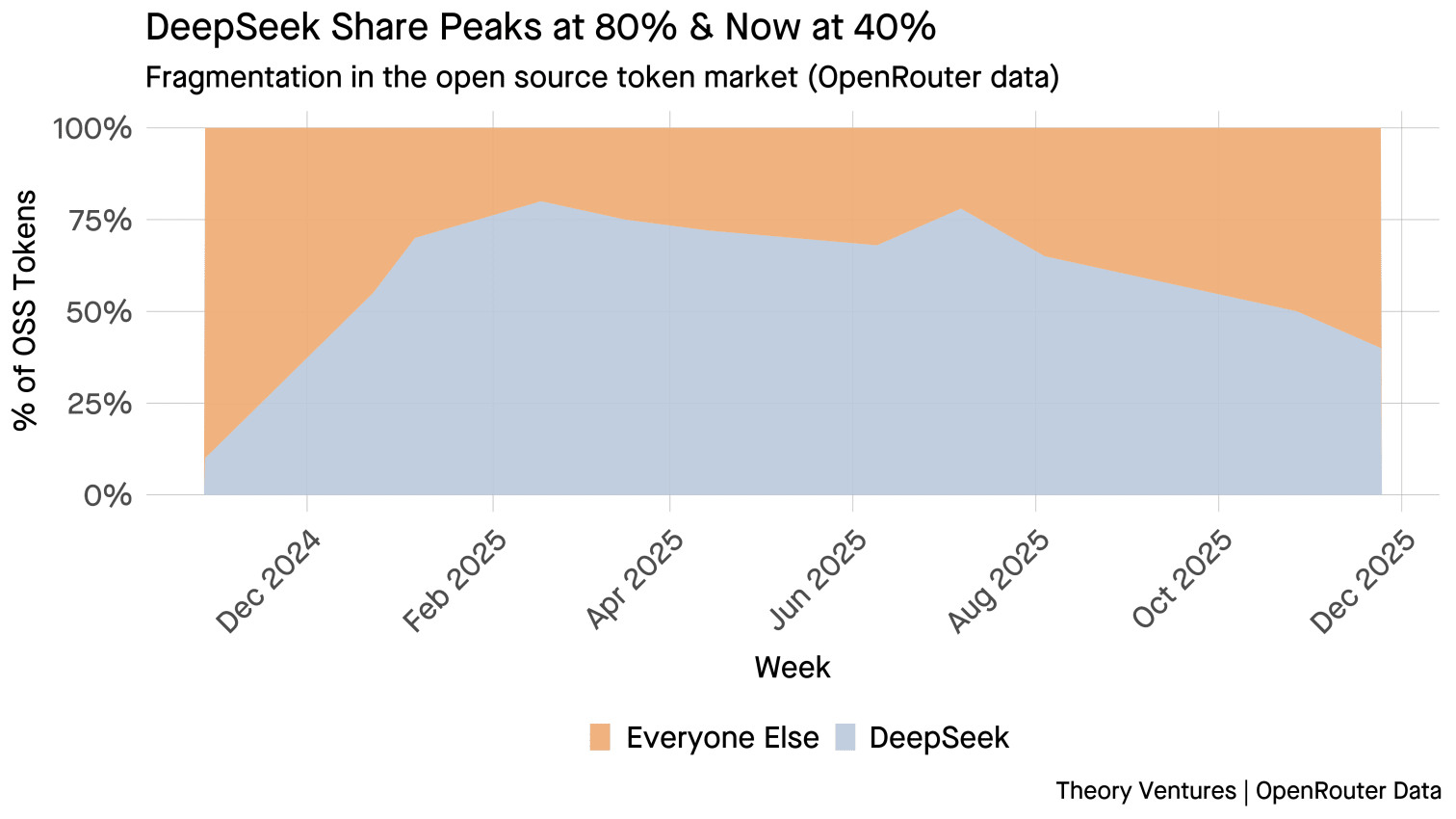

Second, the distribution of open-source models has shifted dramatically. DeepSeek held nearly 80% of OSS market share in early 2025, but has dropped to 40% as Qwen & other Chinese models have gained ground.

Third, coding has found product-market fit. Programming accounts for 60% of Anthropic’s usage & 45% of xAI’s, both heavily skewed toward developer workflows.

The table below shows the top 2 use cases by provider (November 2025). Technology refers to AI assistant tasks like research & summarization.

| Provider | #1 Use Case | % | #2 Use Case | % |

|---|---|---|---|---|

| Anthropic | Programming | 60% | Roleplay | 10% |

| xAI | Programming | 45% | Technology | 15% |

| Qwen | Programming | 27% | Roleplay | 18% |

| Roleplay | 25% | Programming | 20% | |

| OpenAI | Programming | 22% | Science | 20% |

| DeepSeek | Roleplay | 80% | Programming | 5% |

Role-playing is the fast-growing consumer use case. DeepSeek dominates here, with 80% of its volume in roleplay. Cost sensitivity drives this segment, so consumers won’t pay enterprise prices for entertainment.

OpenAI is the only provider with a significant fraction in science. ChatGPT’s early adoption by academics & researchers likely created lasting habits, giving OpenAI an edge in scientific workflows.

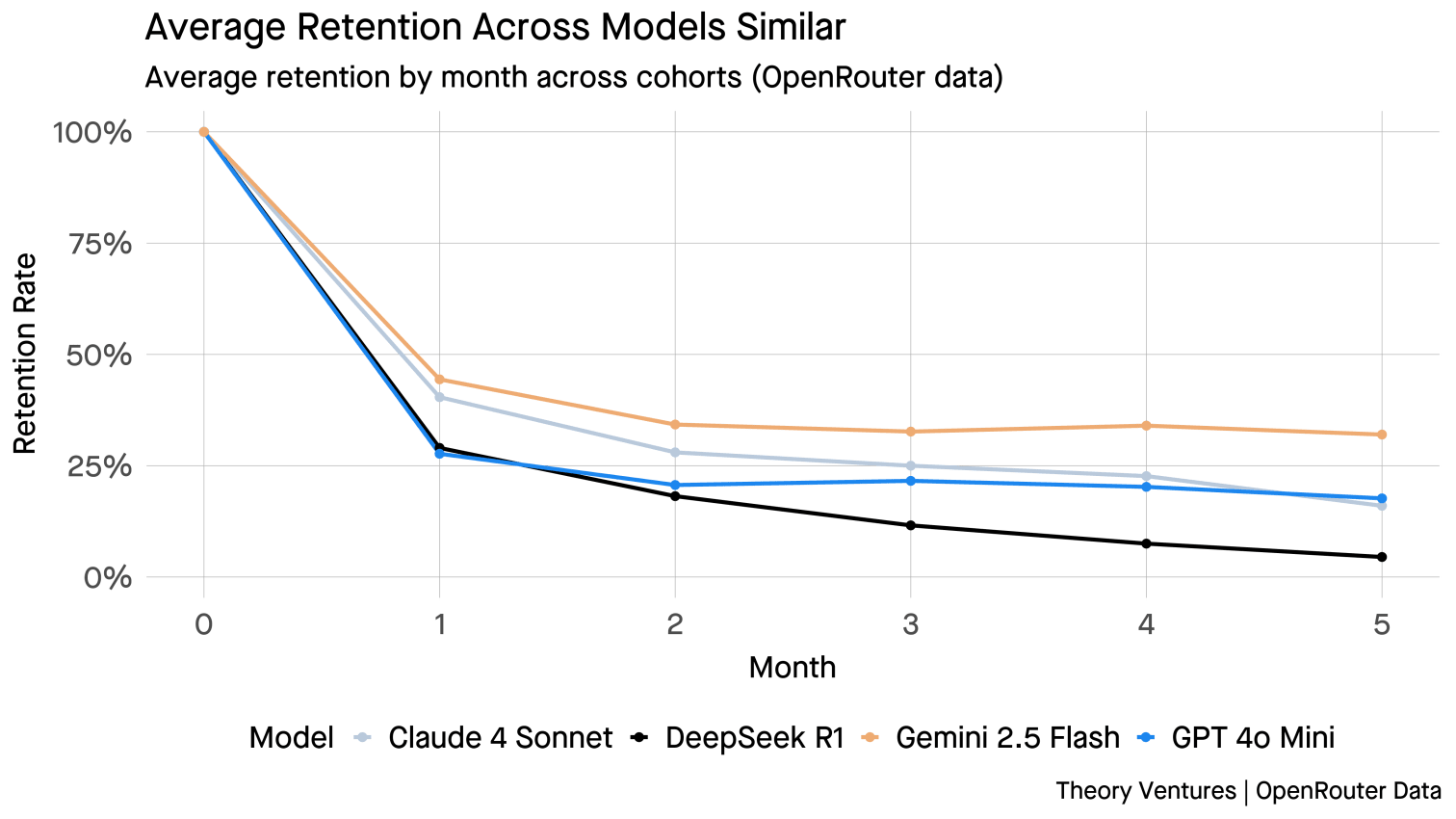

Once a model achieves product-market fit, retention improves significantly. But stickiness is rare, churn is the norm, most models lose 60-70% of users within the first month.

The chart below contrasts retention across leading models. Claude 4 Sonnet & Gemini 2.5 Flash show stronger Month 1 retention (40-50%) compared to GPT-4o Mini & DeepSeek R1 (25-35%), suggesting deeper utility for certain workflows.

The answer to the pricing puzzle : enterprises pay for precision, consumers pay nothing for play. Proprietary providers don’t need to compete on price, they’ve won the segment that pays.

Data Sources:

- Model Usage & Share: OpenRouter State of AI Report (2025). Data points reflect usage as of November 2025.