Recently, we’ve seen a series of product-driven companies building huge customer bases with tremendous account expansion and terrific sales efficiency. DataDog is no exception. DataDog provides a very popular IT monitoring solution that has grown from its founding in 2010 to a huge business. During that time the product has grown from infrastructure monitoring to application performance management, logging and user experience products. The company published its S-1 Friday.

DataDog counts more than 8800 customers, 590 of which spend more than $100k, and 40 of which spend more than a $1M. No customer represents more than 5% of ARR, which means the largest customer isn’t spending more than $15M a year - still huge.

The company’s business is predominantly in the US. 24% of revenues are international.

Additionally, the product expansion has borne fruit. New products generated 35% of bookings last year.

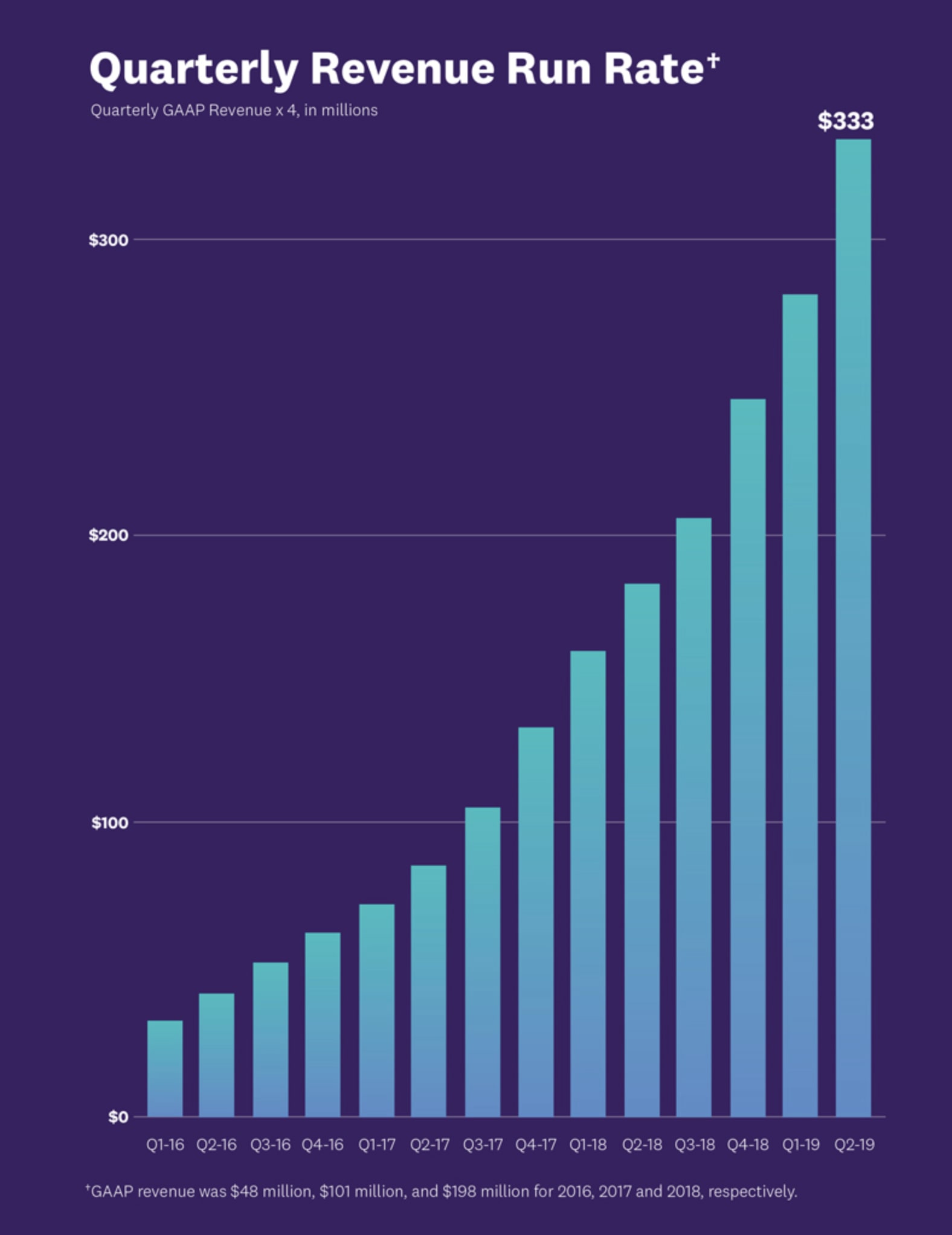

The company is currently at $333M in quarterly ARR and generated $265M in trailing 12 months revenues, up from $145M the previous period. Look at that beautiful curve!

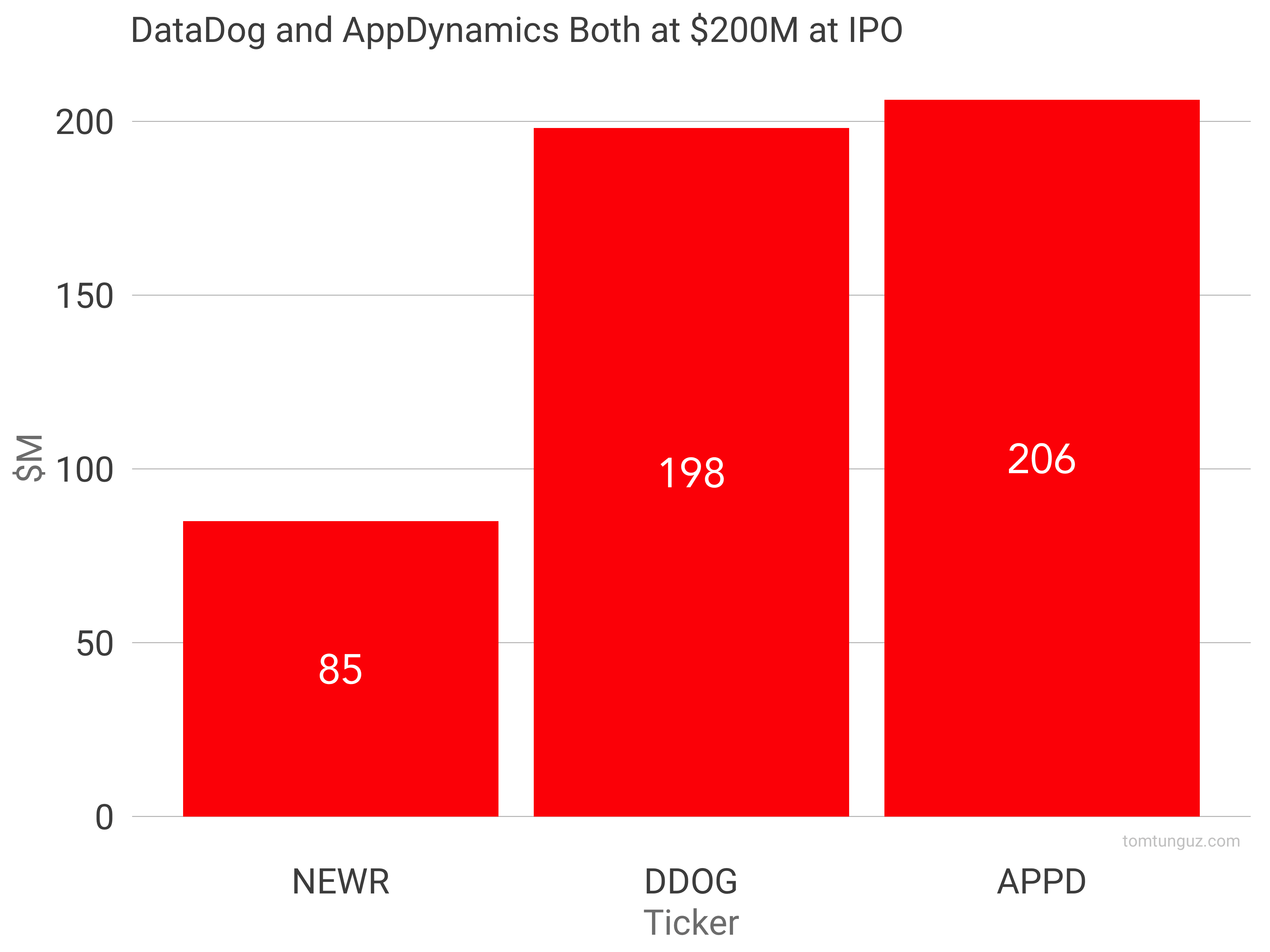

To put the company’s stellar trajectory in context, I’ve plotted its metrics relative to two other incredible monitoring companies: NewRelic (NEWR) and AppDynamics (APPD). NewRelic is public and is worth $3.3B as of this morning. Cisco acquired AppDynamics for $3.7B in 2017, the day before their IPO.

At the time of IPO, both DDOG and APPD filed at about $200M in revenue. NewRelic filed with about $85M. This has more to do with the trend that current IPOs tend to be around $200M and New Relic went public in 2014, when the median revenue at IPO was closer to $100M.

At the time of IPO, both DDOG and APPD filed at about $200M in revenue. NewRelic filed with about $85M. This has more to do with the trend that current IPOs tend to be around $200M and New Relic went public in 2014, when the median revenue at IPO was closer to $100M.

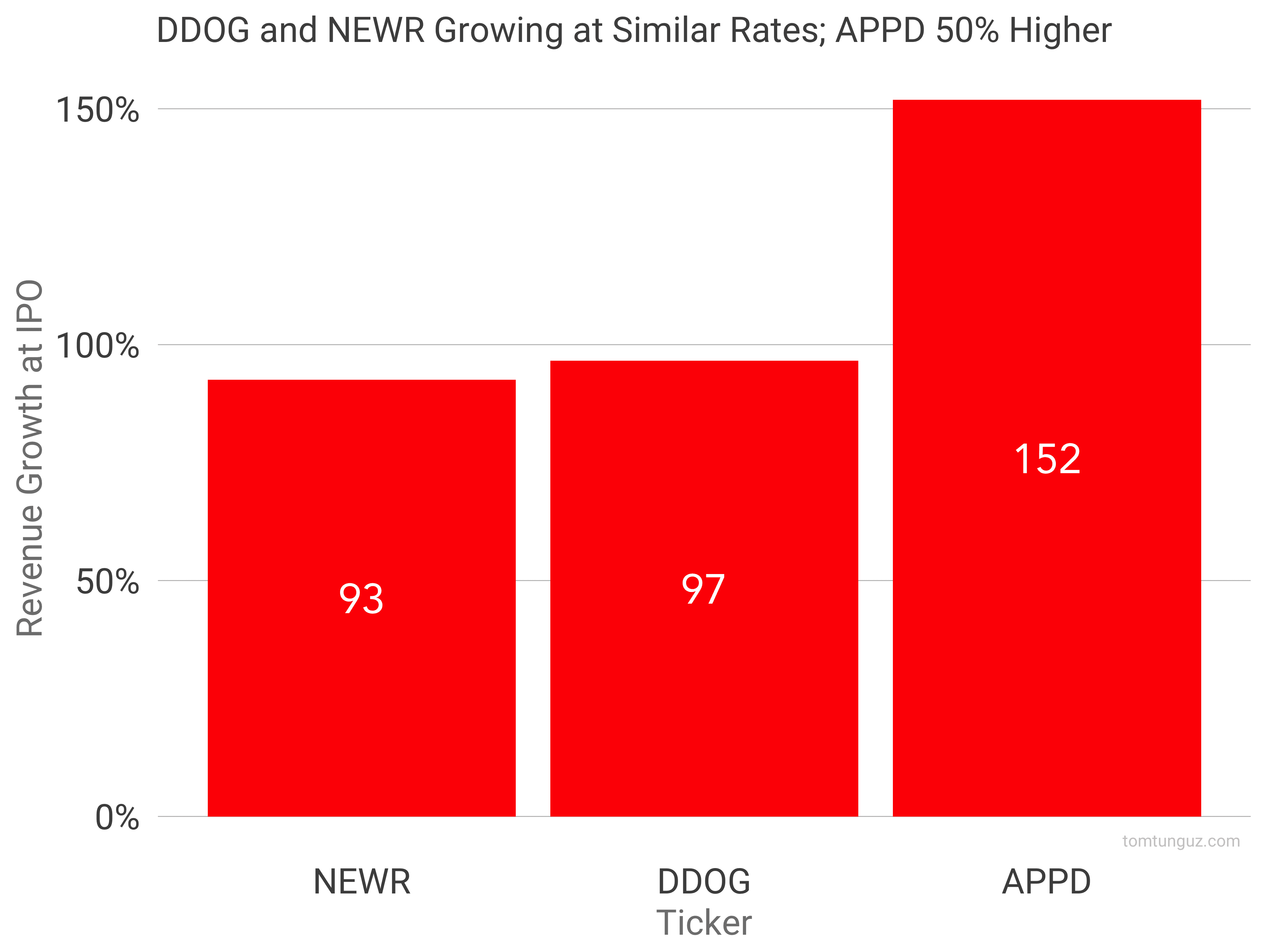

New Relic and DataDog grew at similar rates in the year before the IPO at about 95% each. AppDynamics grew 150%, quite a bit more. But this chart doesn’t tell the whole story. DataDog is 2x the scale of New Relic but growing just as fast. And as for the comparison to AppD…

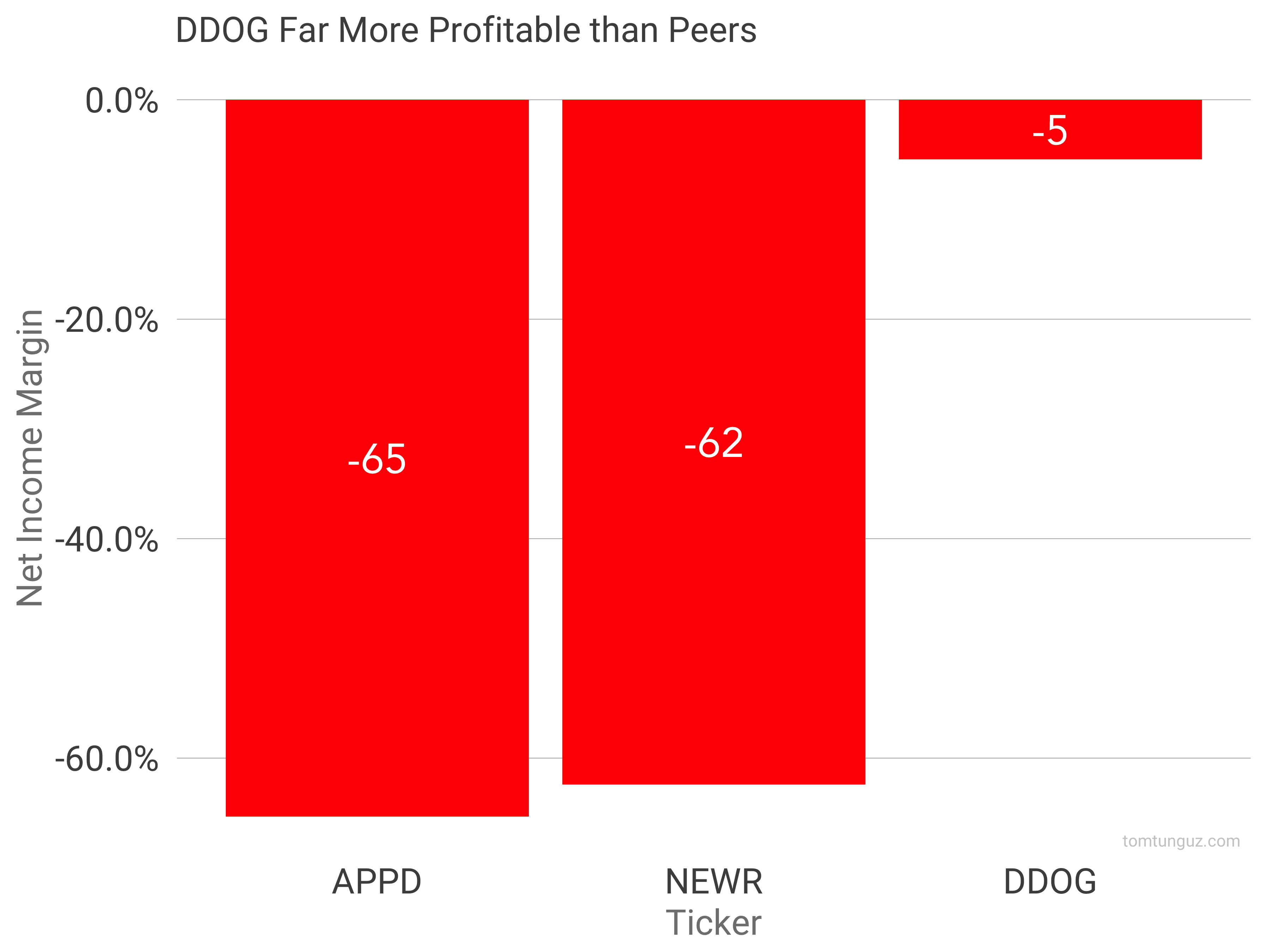

DataDog is effectively profitable compared to its peers, who were at about -65% net income margin. An amazing feat to be growing fast at scale and profitable.

DataDog is effectively profitable compared to its peers, who were at about -65% net income margin. An amazing feat to be growing fast at scale and profitable.

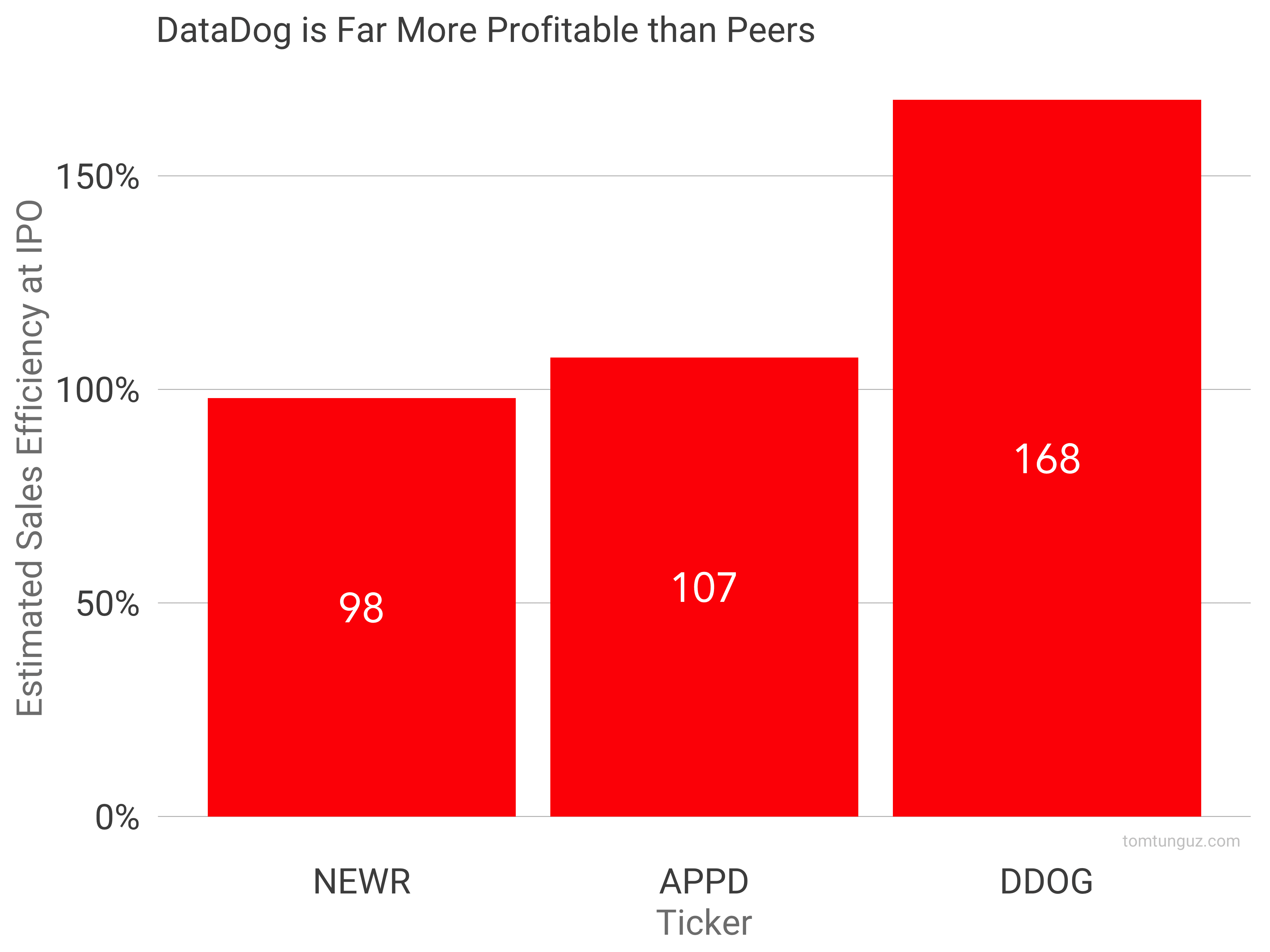

Here’s why:

For every dollar of sales and marketing investment, DataDog generates $1.68 of gross profit, 60% better than the others.

For every dollar of sales and marketing investment, DataDog generates $1.68 of gross profit, 60% better than the others.

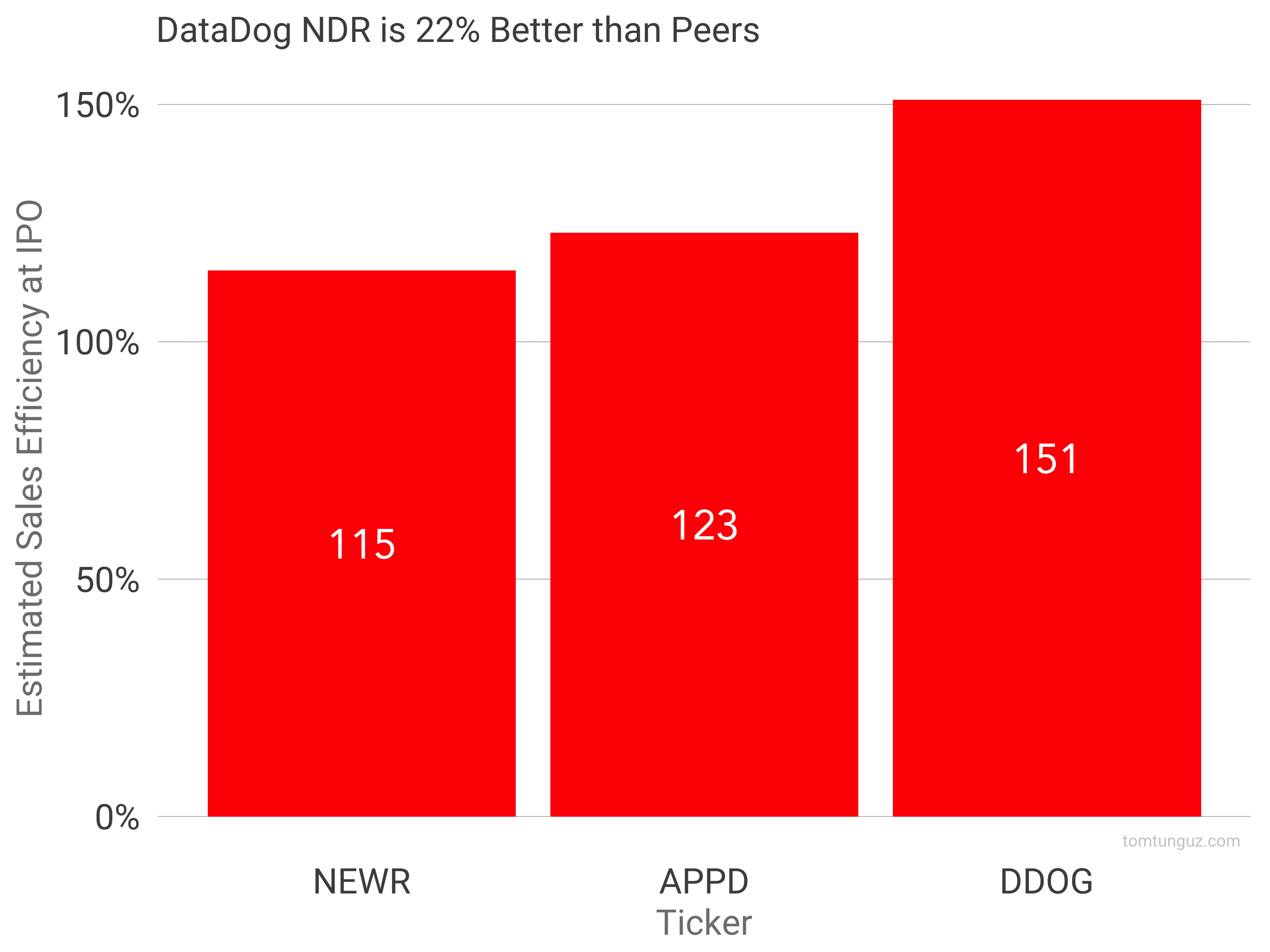

A big part of this sales efficiency is the net dollar retention difference across the group. NDR is the value of a cohort of customers one year after they sign. It includes lost and expanded customers. In DataDog’s case, a cohort that generated $100 last year will generate $151 this year, more than 22% higher than NEWR and APPD.

A big part of this sales efficiency is the net dollar retention difference across the group. NDR is the value of a cohort of customers one year after they sign. It includes lost and expanded customers. In DataDog’s case, a cohort that generated $100 last year will generate $151 this year, more than 22% higher than NEWR and APPD.

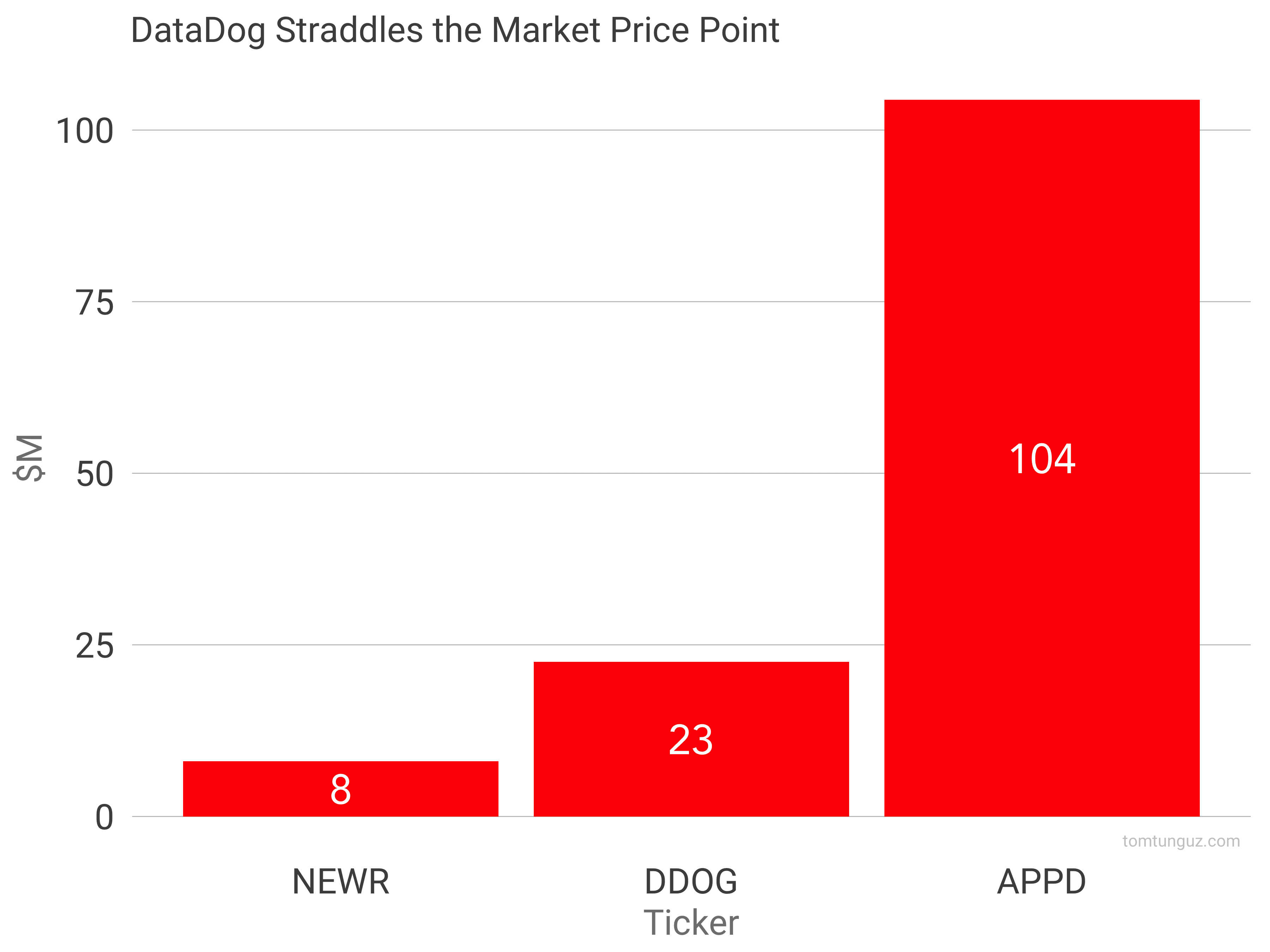

DataDog’s average customer is worth $23k at IPO, compared to $8k for New Relic and $104k for AppDynamics. This average and the data points above about the number of $100k and $1M accounts suggests DataDog serves customers across the spectrum. NewRelic started with smaller accounts. AppDynamics started with enterprise accounts and they met in the mid-market. DataDog is playing across price points.

DataDog’s average customer is worth $23k at IPO, compared to $8k for New Relic and $104k for AppDynamics. This average and the data points above about the number of $100k and $1M accounts suggests DataDog serves customers across the spectrum. NewRelic started with smaller accounts. AppDynamics started with enterprise accounts and they met in the mid-market. DataDog is playing across price points.

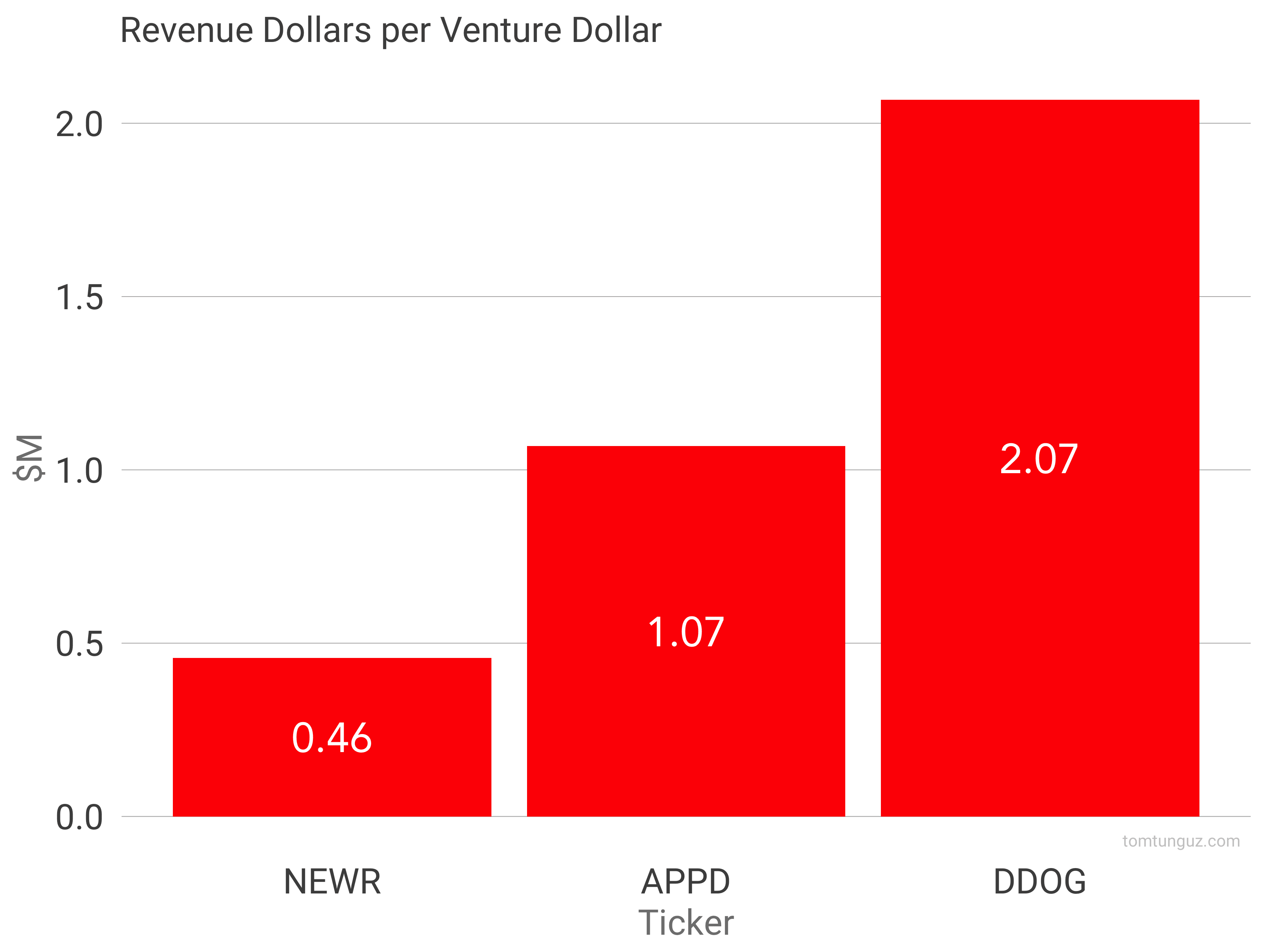

One last chart: revenue dollars at IPO per venture dollar invested. This is a measure of turning investment dollars into revenue, a sort of return on equity metric. DataDog’s return on equity is 2-4x its peers.

In every dimension, DataDog is an exceptional business. It has a beautiful and efficient product-led go-to-market that enables it to grow at incredible rates efficiently. Congratulations to the team and the investors in the business on a marvelous company.