2 minute read / May 25, 2023 /

The Publicly Traded Company Worth 250x More in 10 Years

Ten years ago, Nvidia’s market cap hovered around $4b, down from its previous high of $13b in 2008.

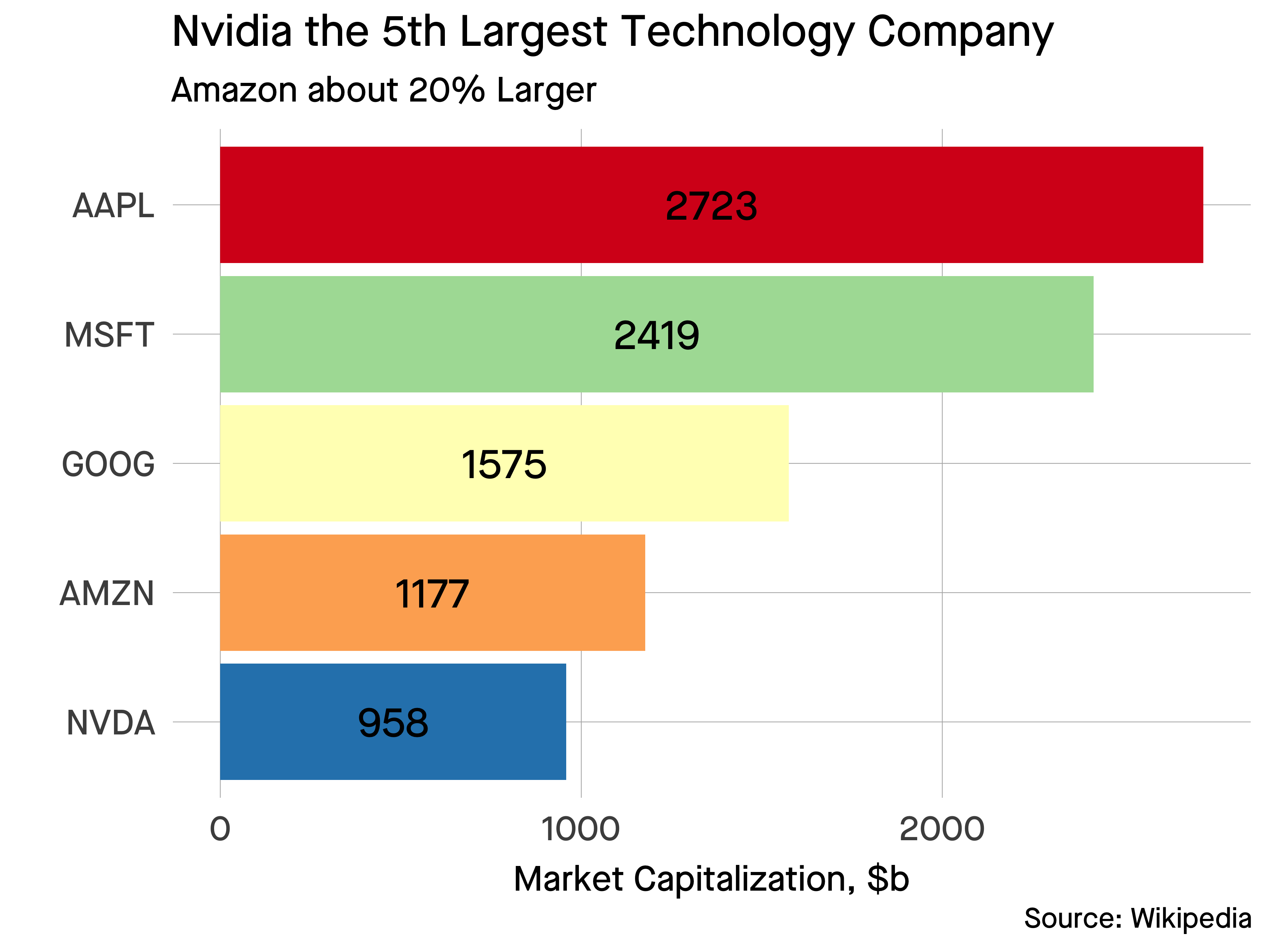

Today, Nvidia is the fifth most valuable technology company in the US, worth nearly $1t - just 20% less valuable than Amazon.

In a decade, the business increased in value about 250x, compounding at about 74%.

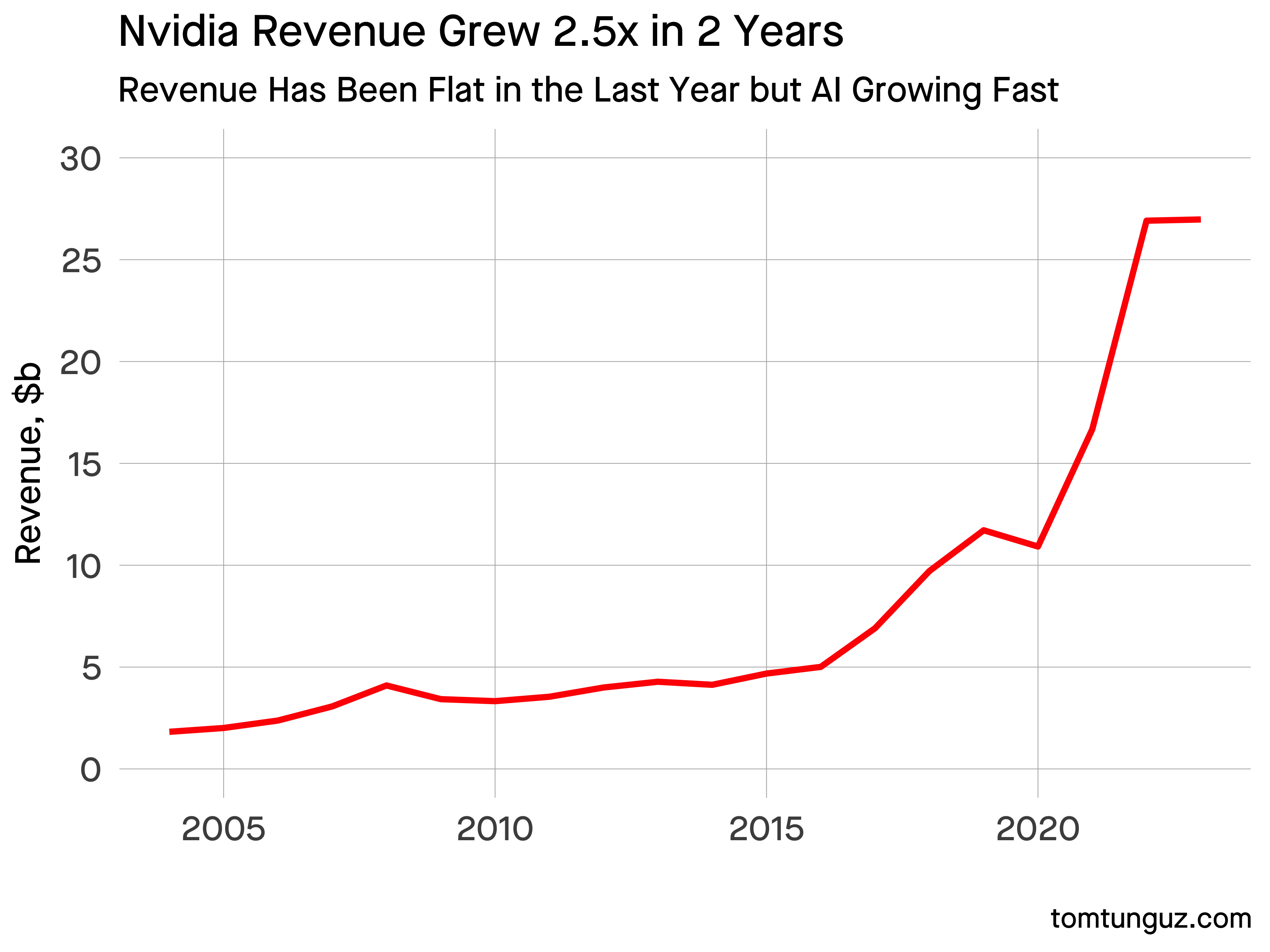

Nvidia’s most recent breakout occurred in the last two years.

In the late 2010s, machine learning inflated demand. Then gamers, at home during Covid, frenzy-fed for newer GPUs to render beautiful games. Crypto demanded hugely powerful machines to solve math to prove transaction validity, again bolstering Nvidia.

Since then, revenue has plateaued because gaming revenue halved.

AI has replaced that demand. Now, cloud companies, major B2B & B2C software companies’ appetite for GPUs has put the Data Center segment on a hypergrowth trajectory.

Nvidia has more than doubled its capex in 2023 & the latest earnings release suggested the business plans to invest more.

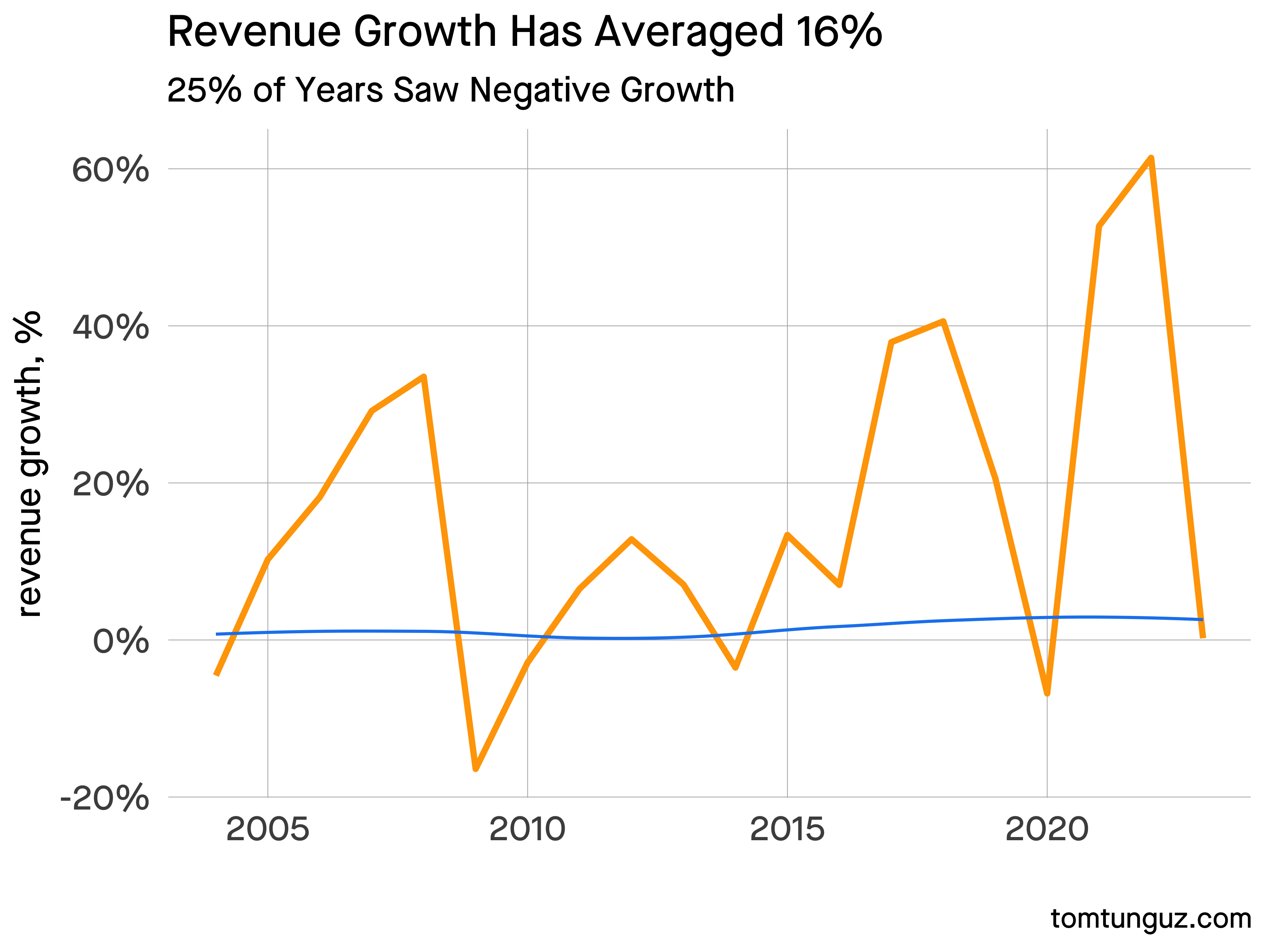

Nvidia revenue growth resembles an electrocardiogram more than a software business, with wild swings in growth rates, and a relatively modest 15% average over the past 20 years.

Nvidia revenue growth resembles an electrocardiogram more than a software business, with wild swings in growth rates, and a relatively modest 15% average over the past 20 years.

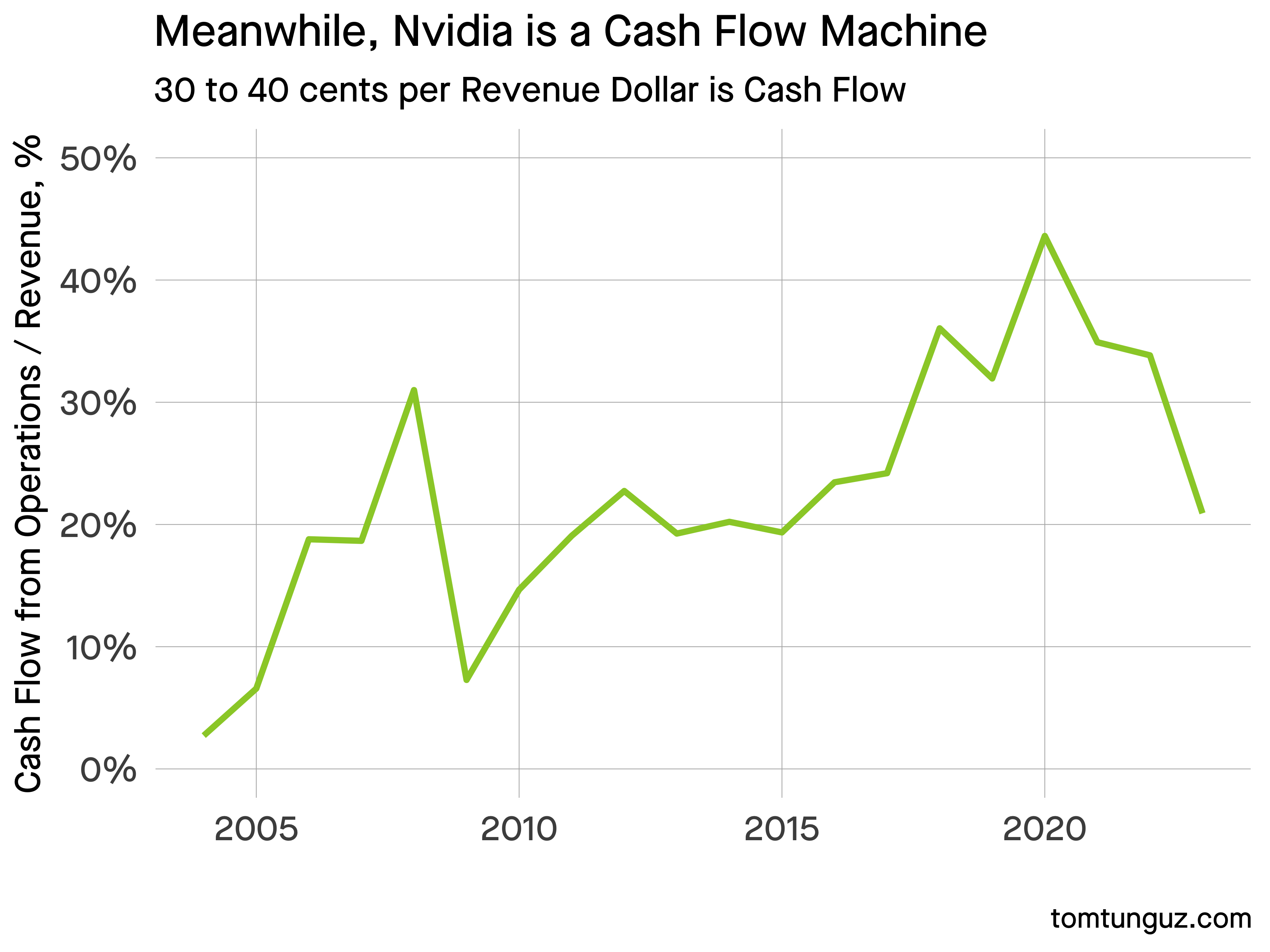

All the while, the company’s management has tuned the machine to produce ever more cash : 30 to 40 cents of every revenue dollar become free cash flow.

All the while, the company’s management has tuned the machine to produce ever more cash : 30 to 40 cents of every revenue dollar become free cash flow.

Nvidia’s boom & bust cycle is a microcosm of the waves that permeate Startupland: internet boom, online video streaming, massive gaming interest, & today machine learning.

The stock now trades at about 16x forward revenues, greater than any publicly traded software company, despite the transactional nature of chip sales.

So much is the enthusiasm for machine learning, investor appetite for AI exposure, that the stock surged nearly 30% after posting earnings - the single largest value change in a stock ever in dollar terms.

Nvidia’s surge reveals in public market the enthusiasm & euphoria over a new technology that could produce 1000x more GDP gains than the personal computer.