2 minute read / Apr 19, 2016 /

Have VCs Changed Their Seed Investment Strategies?

Starting in late 2015 through the first quarter of 2016, founders have shifted their seed fundraising strategies toward a single investor. Seeds led by a single investor have increased by 50% in these trailing six months. How much of this trend is due to greater participation of venture capitalists investing in the seed market?

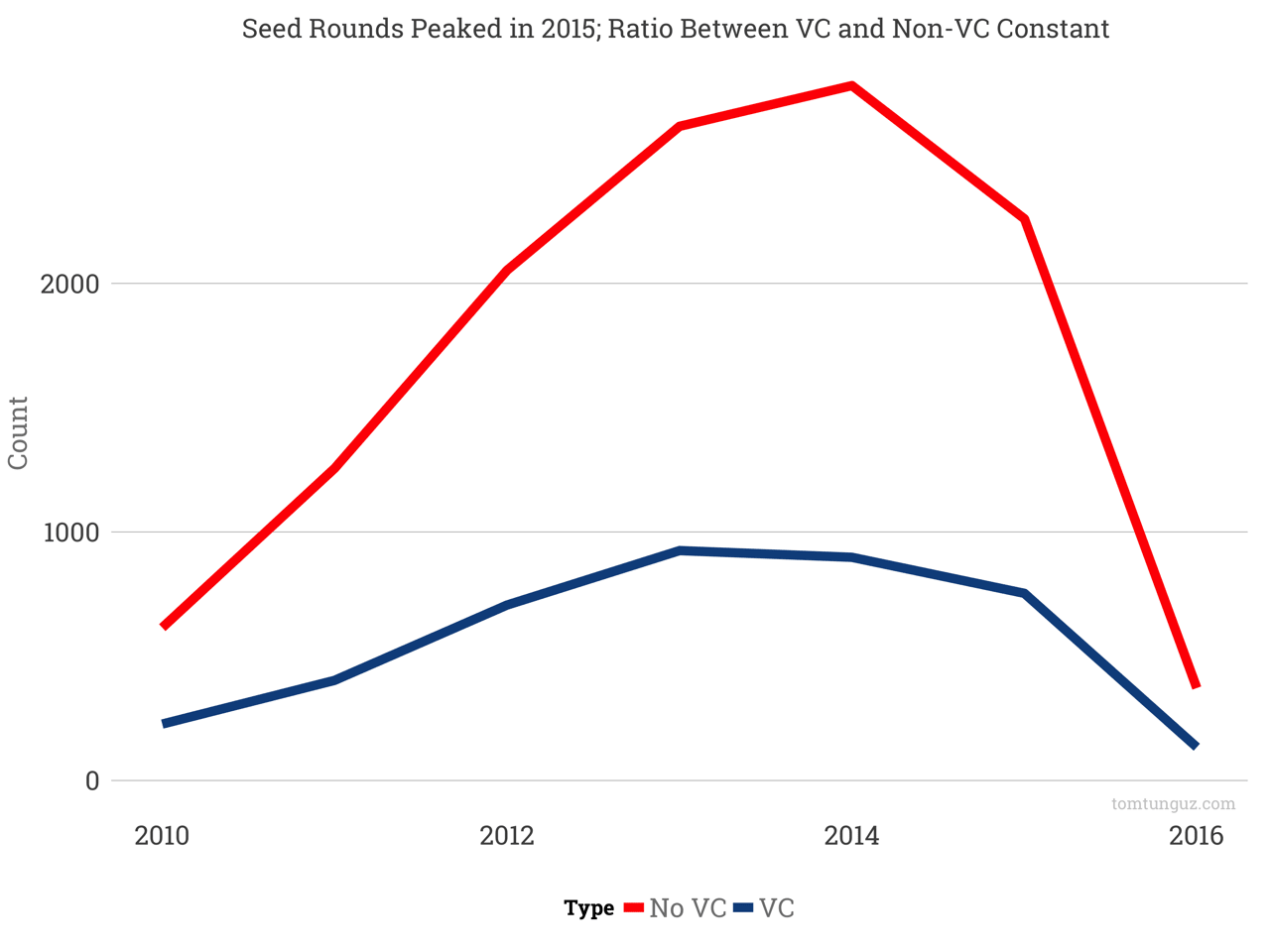

The chart above plots the number of seeds rounds by year. Rounds with VC participation are marked in blue, and those without VCs in red. Both types of rounds have increased by about 5x since 2010. Rounds without VC participation seem to be roughly twice as frequent as those with venture funds. This pattern hasn’t changed in the last five years.

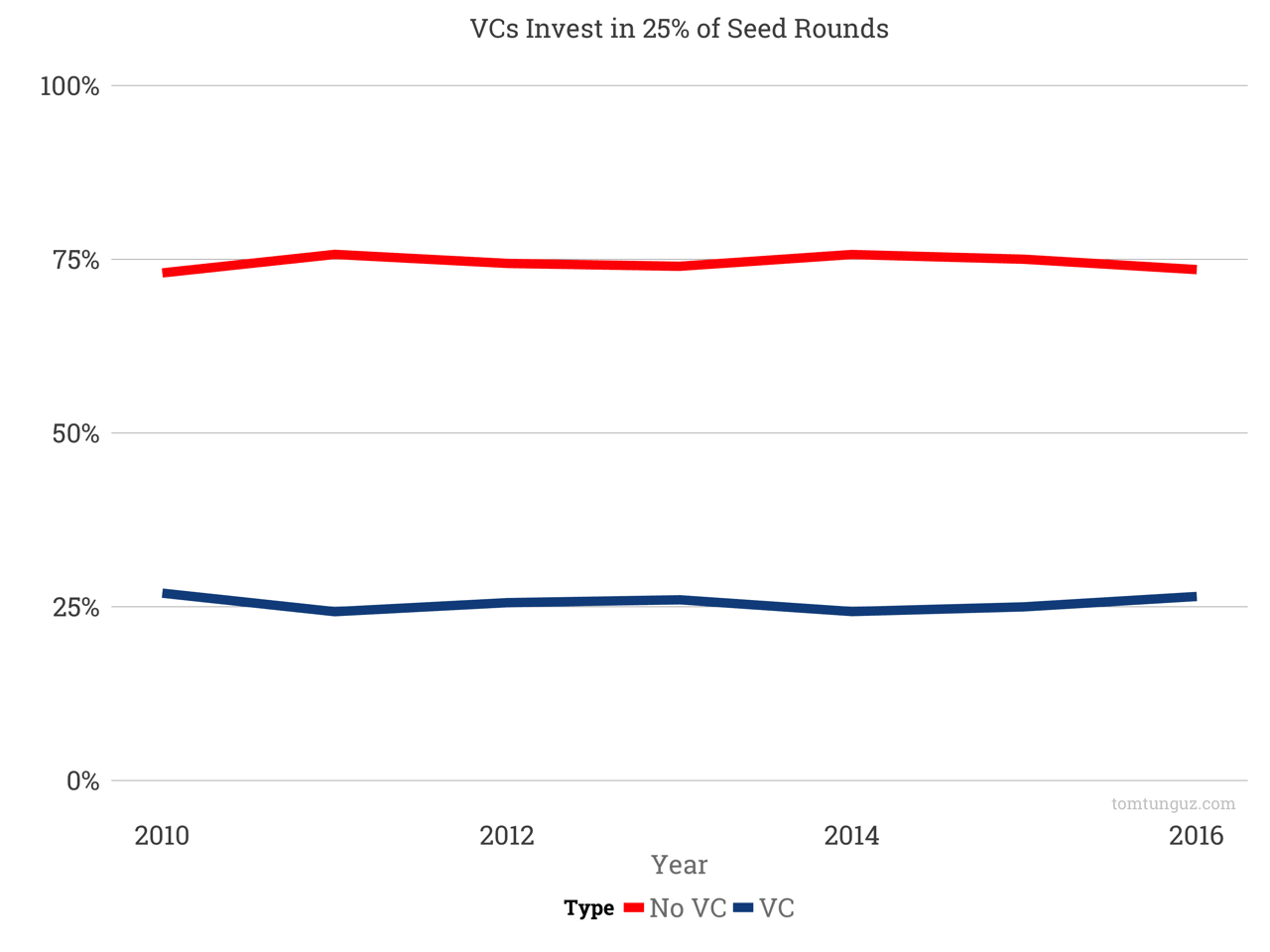

If we examine the data as a percentage of rounds, we see that the share of rounds with VC participation has remained astoundingly identical over this period at 25%. So the data indicates venture capitalists are equally active in the seed market today as a share of total rounds as they have been in the past.

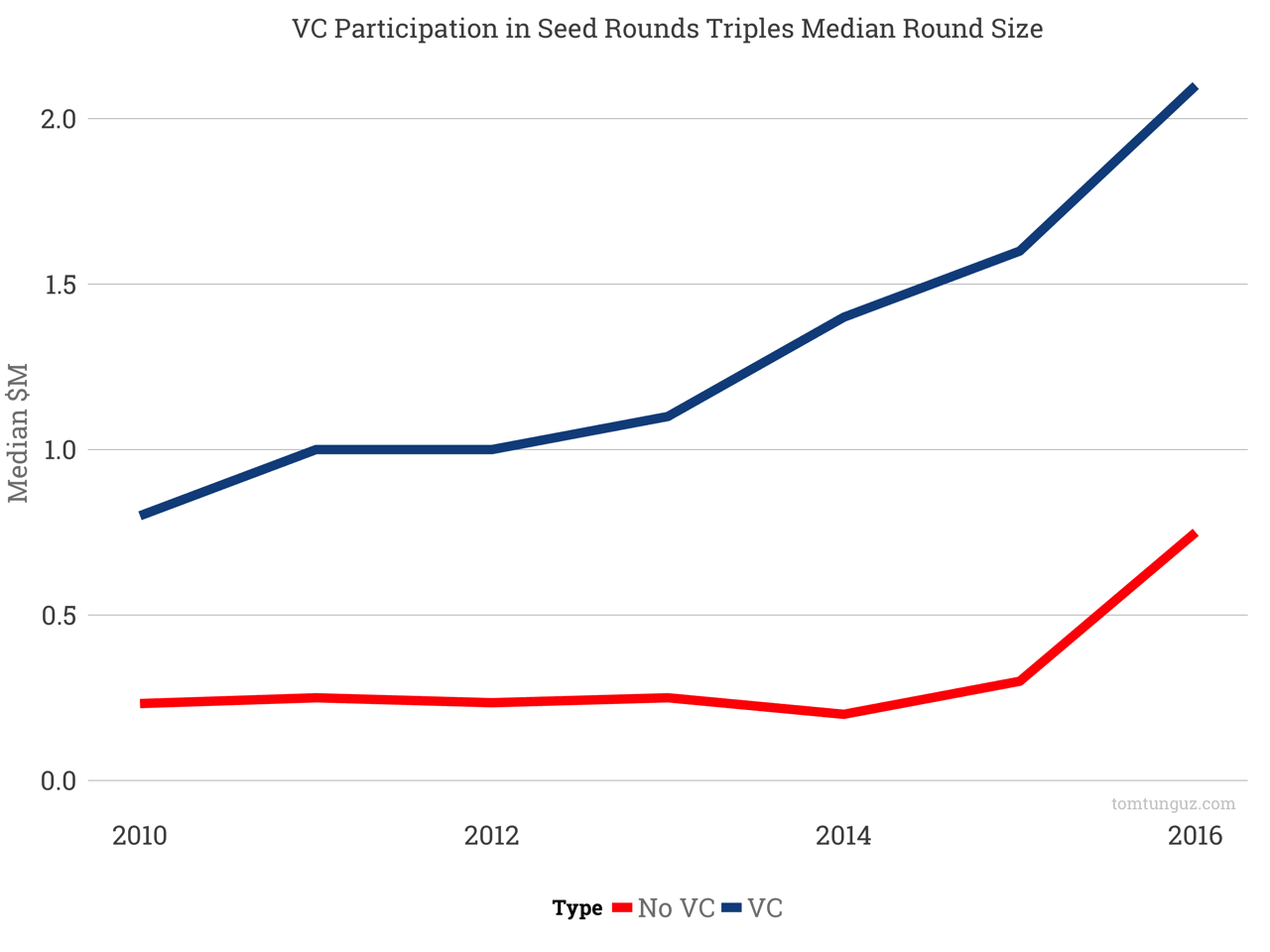

However, seed rounds with and without VC participation differ in the round size. The median seed round with VCs has increased from a median of $800k in 2010 to $2.1M in 2016 Q1. Non-VC seed rounds have swelled with a similar growth rate, but remain about 1/3 the size at $750k.

The withdrawal from the seed market in number of rounds seems to be broad-based, in that both traditional seed investors and venture capitalists, are investing less frequently. But when they do invest, they concentrate their dollars.

Seeds with VCs are growing in size at an amazing rate, and if the trend continues should exceed the $3M mark later this year. At this point, the median seed round could then be called a Series A again. Another flip of Jacob’s fundraising ladder.

- Source: Crunchbase for data and categorization of investor type (angel, micro-vc and venture-capital)