Just how big is the current web3 B2B SaaS total addressable market (TAM)?

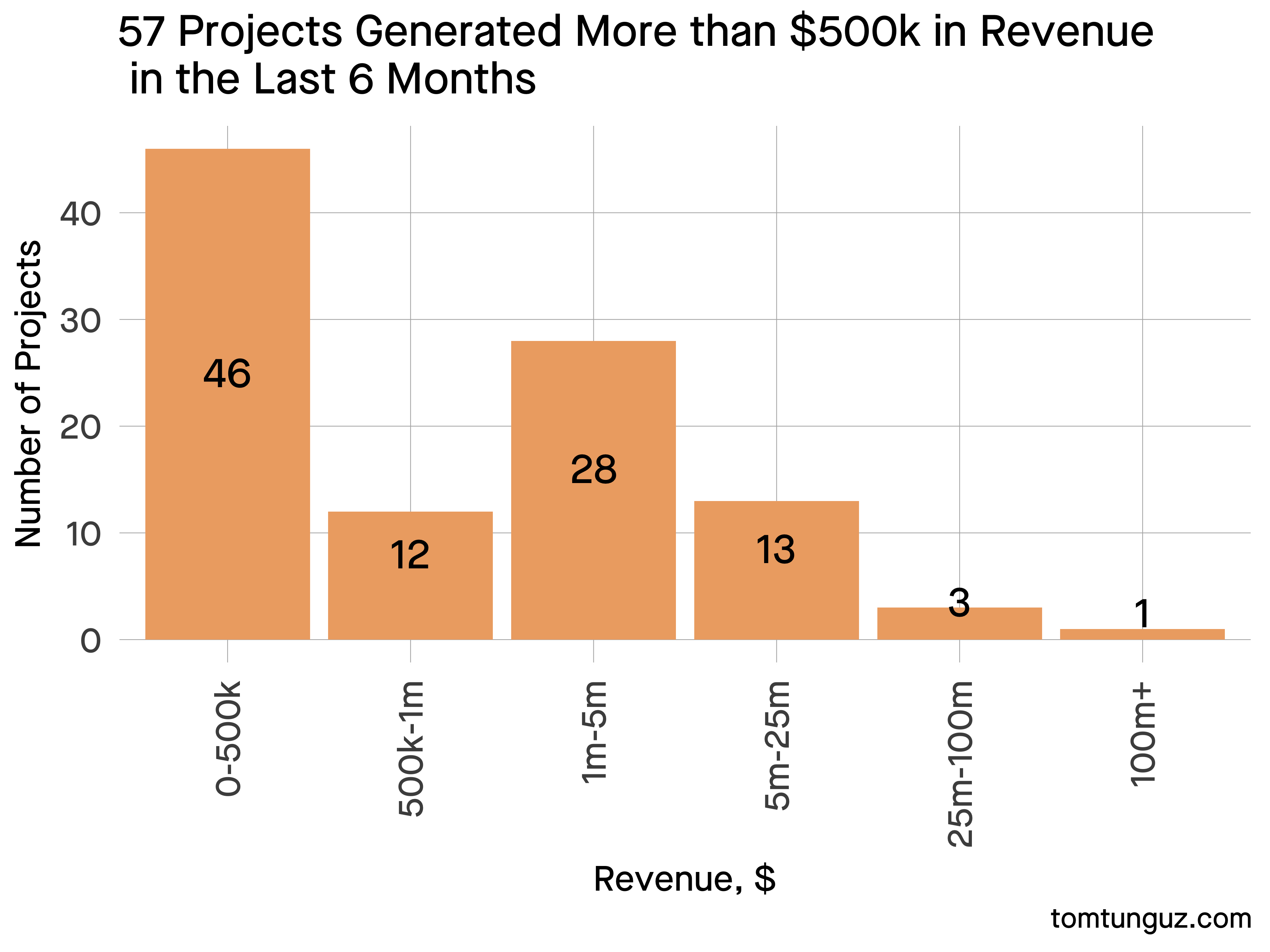

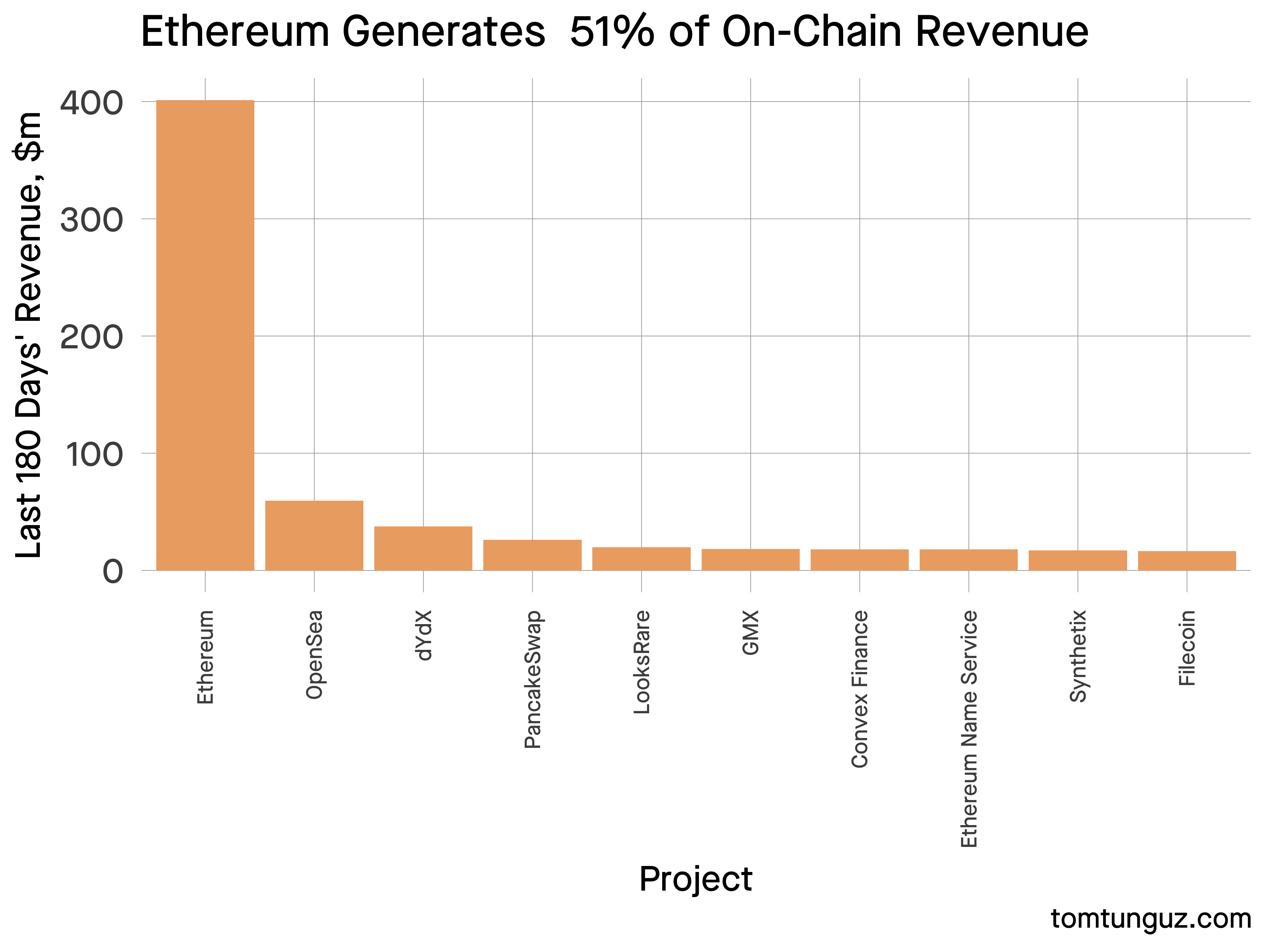

In the last six months, 103 web3 companies generated revenue on-chain, the smallest of which recorded a few hundred dollars of sales & the largest, Ethereum, tallied $401m.

44% of these companies produced less than $0.5m. But a nascent mid-market does exist : 41 companies produced between $5-25m.

| Figure | Value |

|---|---|

| Total Revenue, $M | 771 |

| % of Revenue spent on Software | 30% |

| Implied Web3 Software TAM, $M | 231 |

| Implied Web3 Software TAM (excluding Ethereum), $M | 75 |

The average software company operates at about 70% gross margin, so let’s assume a web3 company is similar. To simplify, we’ll assume the typical web3 company spends all of that cost of goods sold (COGS) on software - about 30% of revenue [1].

That implies the web3 B2B software TAM is roughly $231m in 2022 & $75m excluding Ethereum, which comprises roughly 60% of the revenue.

Web3 software sales must also navigate novel procurement processes with decentralized decision-making, payment for services in kind with tokens, & different permissions models for users.

At a 10x revenue multiple, web3 software should support about $0.75b to $2.3b in startup market cap. Depending on your view on web3 revenue growth, a 10x multiple might be high or low.

The limited number of potential customers challenges web3 vendors. With fewer than 100 accounts willing to spend $20-50k on a software contract, every interaction is precious, especially those larger accounts which dominate revenue.

To contrast with web2, Salesforce counts 150k customers in a market of about 650k who spend $57b annually. This is just the web2 CRM market.

While possible to build a business selling exclusively to web3 companies, the bigger market today is selling web3 technologies to web2 companies. Solutions in gaming, marketing, & financial services where decentralized databases or virtual wallets solve a core business need.

- This is a rough estimate. Most software companies also include customer success in COGS. Fully allocating all COGS to software is aggressive. On the other hand, the software purchased by Sales & Marketing and Research & Development teams isn’t included in that line item. So, this should be a reasonable guess.