During this recession, startups will fall into one of four categories which I wrote about in June.

But, I missed something in this post : the advantages are compounding, which is the reason the biggest will continue to win share.

It’s also the reason changing strategies can be expensive.

This is the time in the startup cycle when big balance sheets become strategic advantages.

First, companies with bigger balance sheets can sustain higher monthly burn rates, which fuels growth.

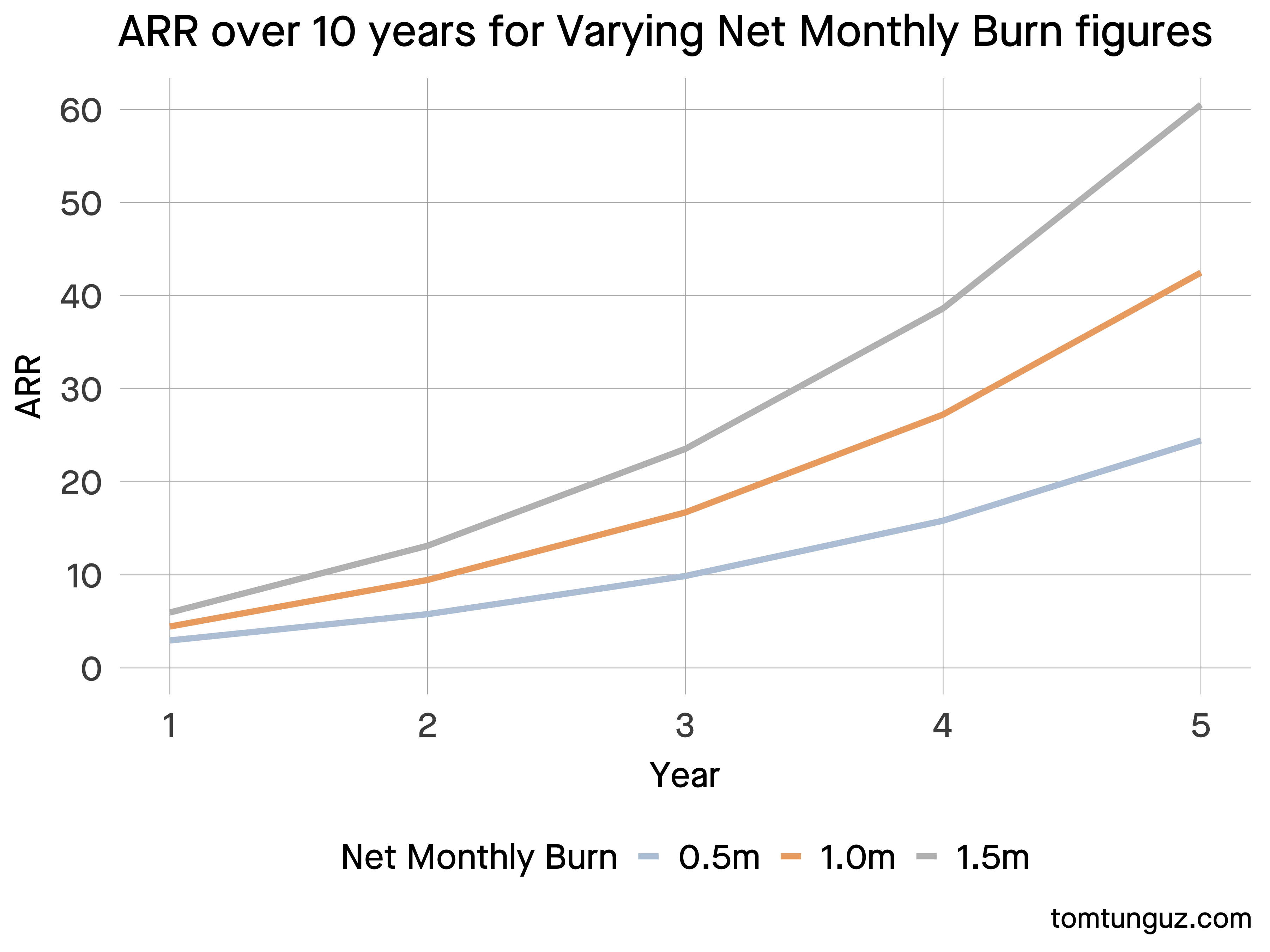

Imagine the same company under three different net burn conditions: $0.5m, $1.0m, & $1.5m in monthly net burn [1]. In five years’ time, the $1.5m scenario triples the size of the $0.5m in monthly net burn.

The elbow of compounding growth creates a minor separation to start, but a yawning gap within a handful of years.

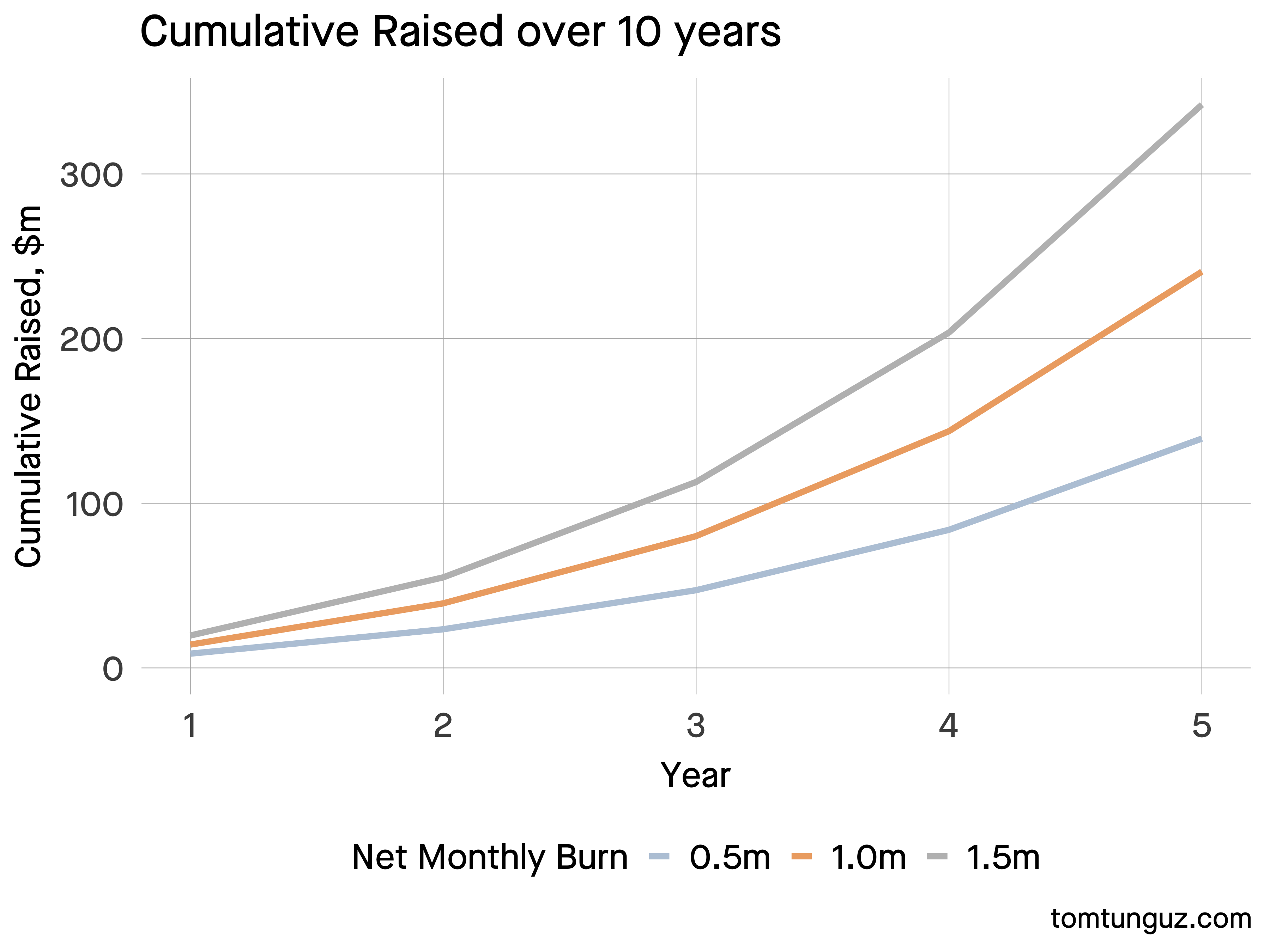

The same phenomenon plays out in the fundraising markets. The faster-growing company raises more capital to reinvest in growth [2].

The richer the balance sheet & the more solid the business model, the greater the growth rate & ability to win market share.

Why does this reinforcing effect exist? Companies with greater presence in the market will build brand, hire more sales teams, pitch more prospects, close more customers. More revenue growth translates into more dollars raised. Note, I haven’t factored in the valuation multiple premia afforded to top quartile growth.

This GTM flywheel accelerates & decelerates startups’ market share. Changing strategies means the compounding effect either increases (spending more to grow) or decreases (conserving cash).

The right strategy depends on the startup’s position in the market & the relative strength or weakness of competition. There’s no single answer, but it’s important to consider the effect of compounding growth in determining a strategy.

Over the next 24 months, we should expect significant market share changes to result because of the compounding effect.

[1] Assumptions: $1m in starting ARR; $25k ACV with a $50k CAC; 30% of ARR + Net Burn invested in Sales & Marketing ; 120% NDR ; constant sales efficiency. % NDR ; constant sales efficiency.

[2] Assumptions: sell 15% of the company at a value of 10x next year’s ending ARR annually.