Why does growth rate matter so much? Why does growth rate influence valuation so much? I was reading a book recently written by a hedge fund manager who discussed valuation frameworks. His explanation was one of the best I’ve come across.

If your business is growing at 100% next year, then 90% the year after, and then about 80% the year after, the business will have grown 6.9x. That’s the way I’ve always looked at company.

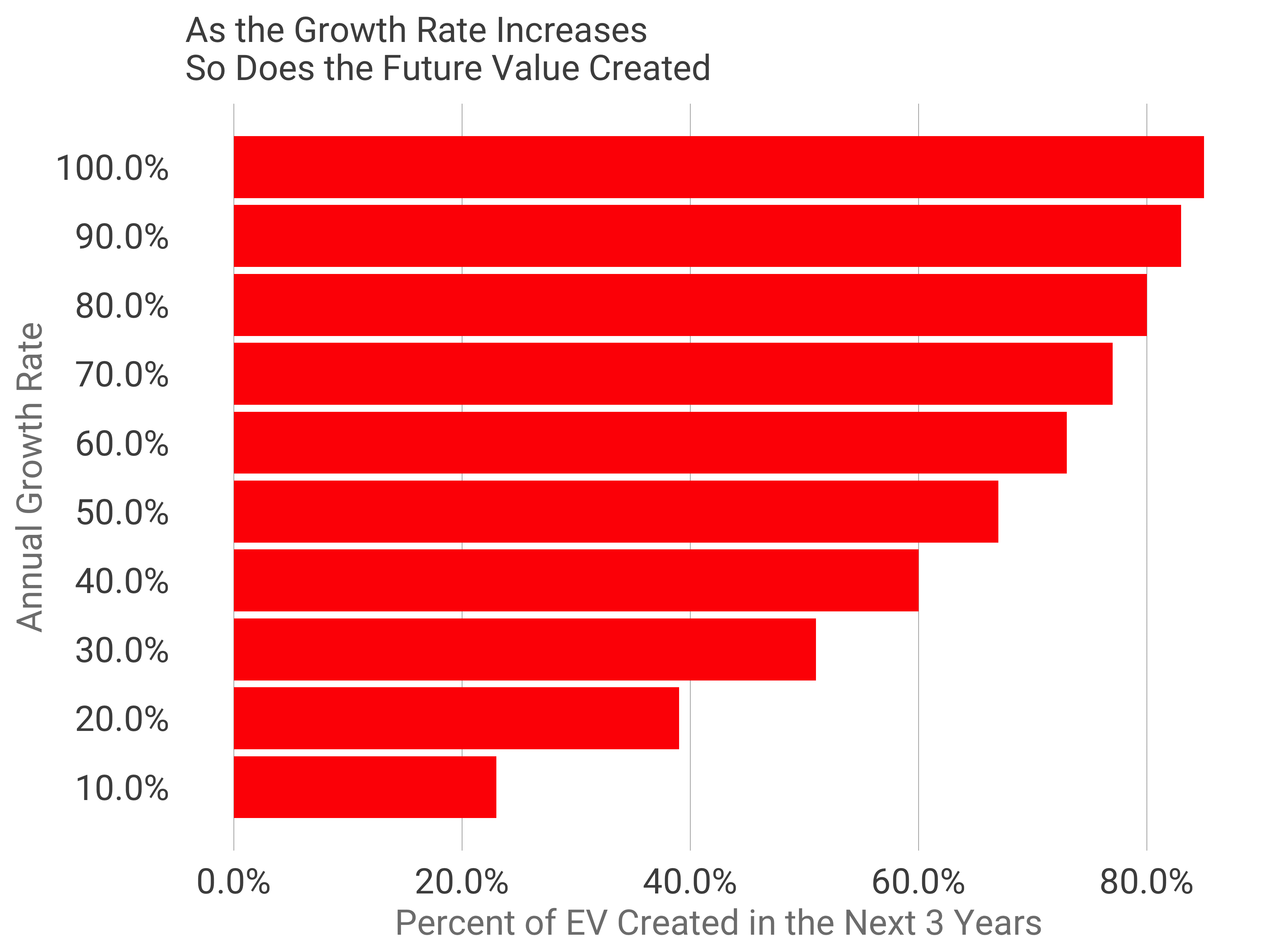

But this hedge fund investor said it a different way: 85% of the value of the business will be created in the next 3 years. At 10% growth, the company’s value today is 77% of the value in three years. The value won’t change that much. It’s already the most of the size it will be.

Same cup, same water, just a different perspective.

The chart above shows how this changes with different growth rates. It assumes a company starts growing at the growth rate on the y-axis. This growth rate falls 10% each year. On the x-axis, you can see the fraction of the enterprise value (EV) that will be created in the next 3 years.

Instead of looking at today’s valuations as a multiple of current revenues, we can think about it as a discount to the future value. This math makes that perspective concrete.

Photo by Daniel Mayovskiy on Unsplash