The Great Liquidity Shift

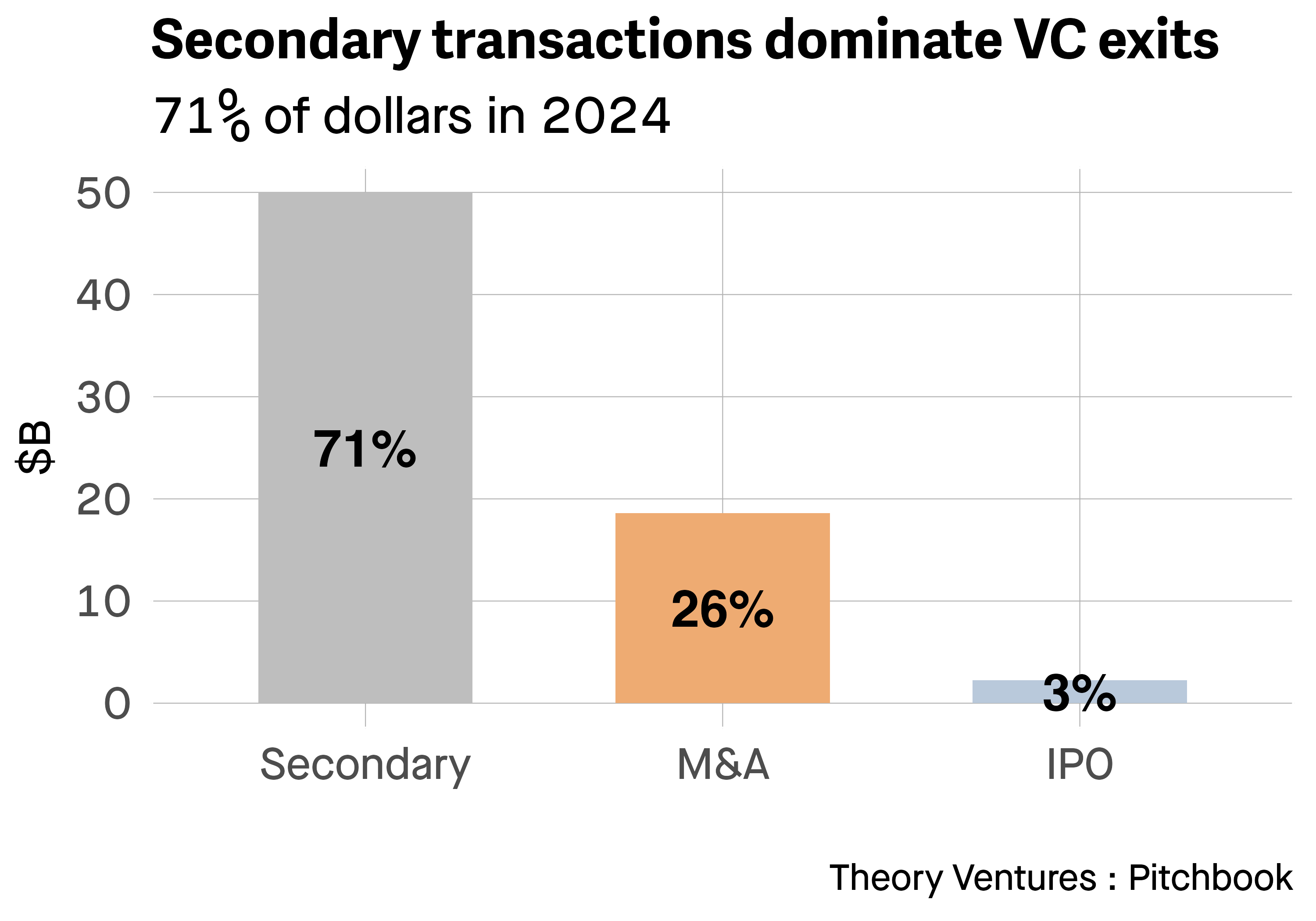

71% of exit dollars in 2024 came from a new avenue : secondaries.

Historically, IPOs and M&A have been the dominant exit paths for venture backed companies. Some years IPOs dominate, other M&A dominates, but in 2024 secondaries captured the super majority.

When a company sells new shares to investors in exchange for dollars, they create new shares in the company - primary shares. When existing shareholders sell their shares to new investors, we call this a secondary sale. An employee tender is a secondary sale offered to employees of the company. But secondary sales can also occur between one venture capitalist and another venture capitalist.

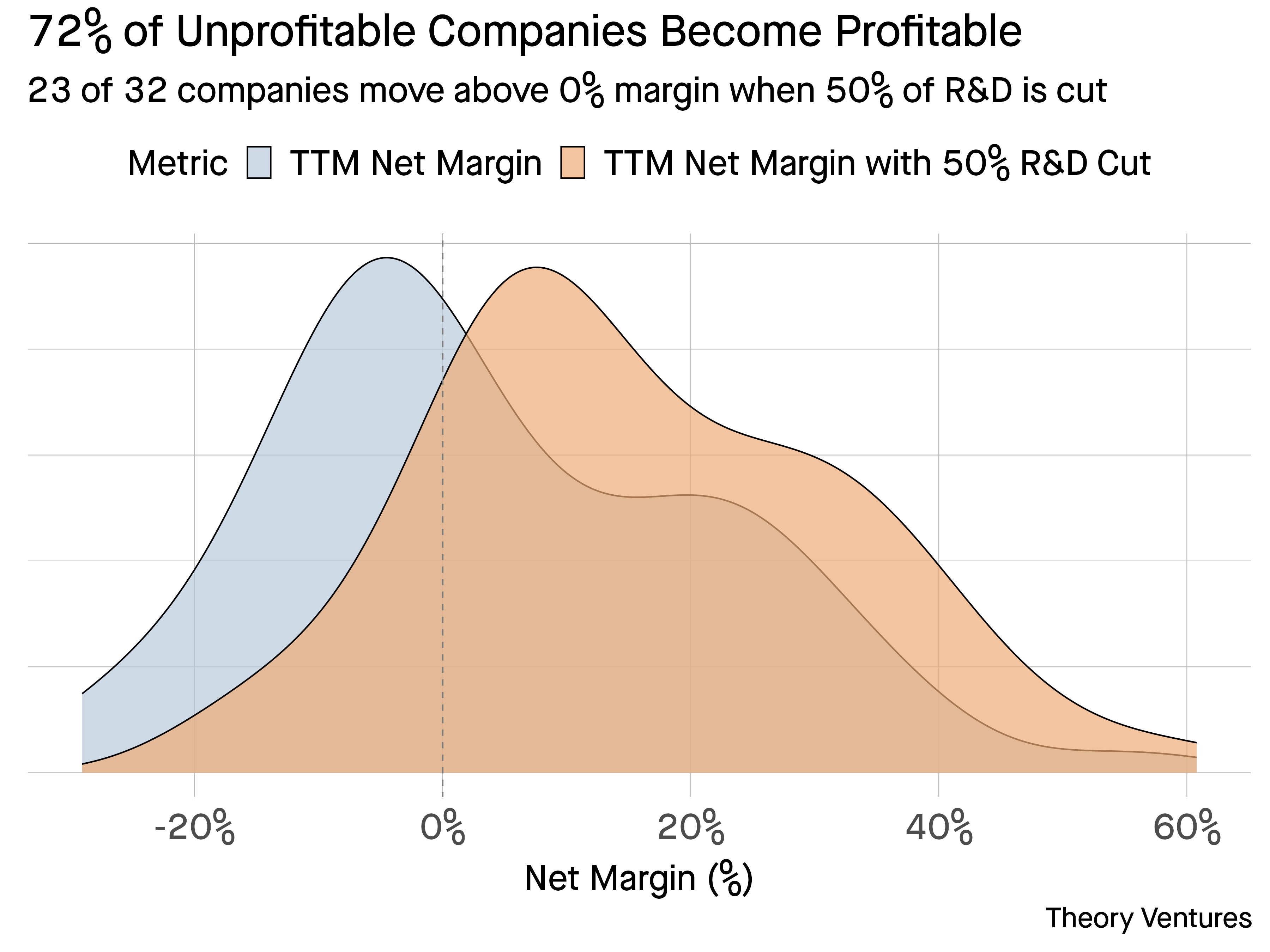

72% of unprofitable SaaS companies would become profitable.

72% of unprofitable SaaS companies would become profitable.