This year, private equity firms have acquired five public software companies, totalling $38b in value. Seven months into 2022, these figures exceed last year’s totals, something I wondered about last month.

Since these transactions’ details are public, we can use them to infer how the private software market values companies.

| Company | Acquirer | Price | Growth Rate | Multiple | FCF Margin | |

|---|---|---|---|---|---|---|

| Avalara | Vista | 8.4b | 32% | 9.2x | 2% | |

| Ping Identity | Thoma Bravo | 2.4b | 13% | 6.6x | 6.2% | |

| Zendesk | Hellman Friedman | 10.2b | 31% | 5.1x | 10.5% | |

| Anaplan | Thoma Bravo | 10.4b | 33% | 13.4x | -6% | |

| Sailpoint | Thoma Bravo | 6.9b | 22% | 11.1x | -2% |

In the last decade, a software company’s revenue growth correlated most highly to its valuation multiple.

In this small data set, growth rates don’t correlate to multiples. Neither does profitability (net income margin), which clocks in at -0.13.

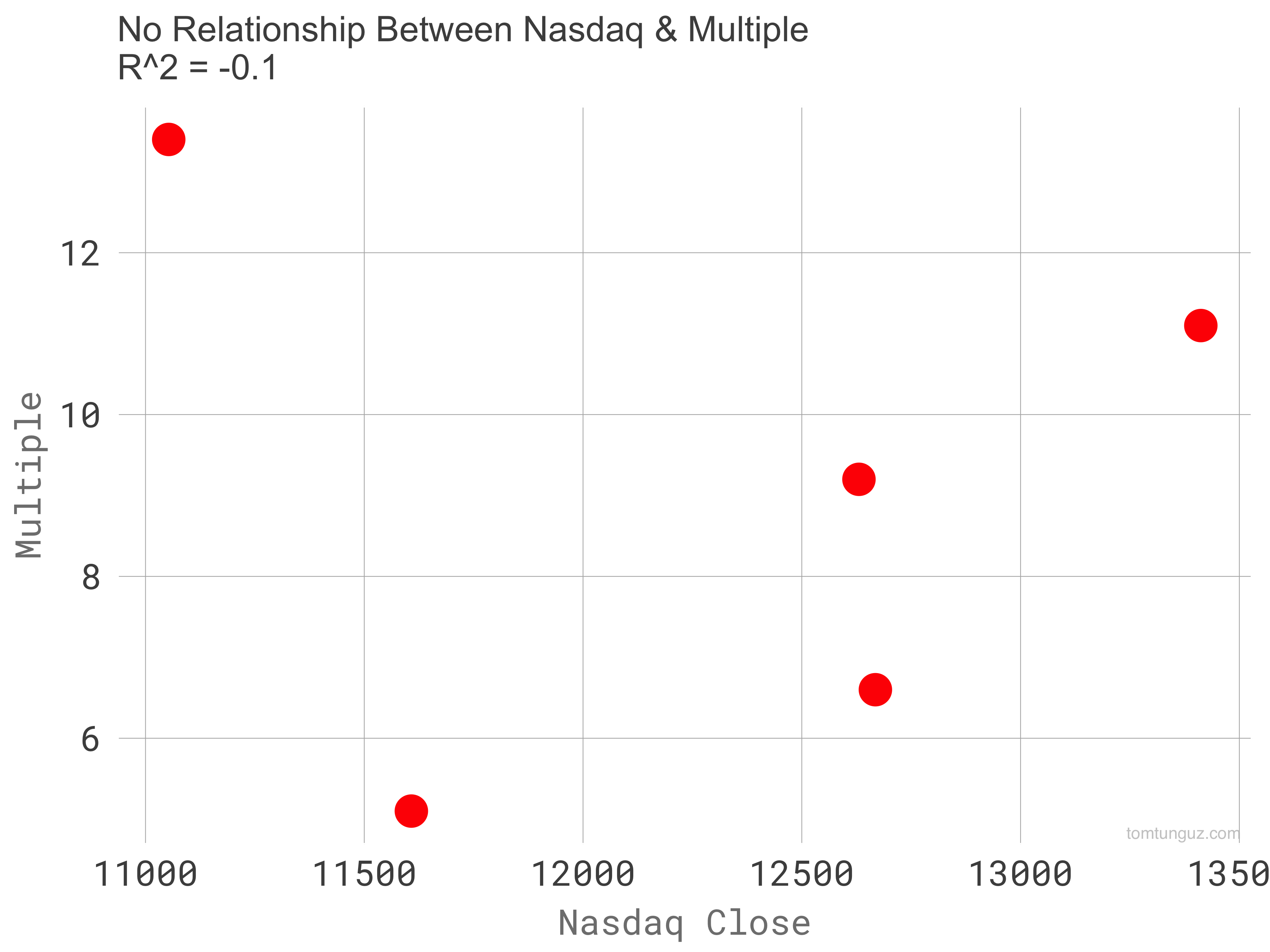

I wondered if the Nasdaq’s recent rebound might have influenced these numbers: strong Q1, crash in Q2, & then some resurgence of late. But no relationship exists between the Nasdaq’s price level & multiples. Zendesk & Anaplan announced their acquisitions within days of each other & their multiples bound the outer edges of the range: 5.1x & 13.4x.

I wondered if the Nasdaq’s recent rebound might have influenced these numbers: strong Q1, crash in Q2, & then some resurgence of late. But no relationship exists between the Nasdaq’s price level & multiples. Zendesk & Anaplan announced their acquisitions within days of each other & their multiples bound the outer edges of the range: 5.1x & 13.4x.

Curiously, free-cash flow margin correlates to forward-revenue/EV multiples at -0.996. A perfect negative correlation. The more free cash the company produces, the lower the acquisition multiple. I’m at a loss to explain this relationship. Perhaps a reader who understands the PE model more deeply will write in to explain it.

However, we can glean some insights. The data suggests the market has attained a pricing floor. Multiples bear no correlation to the Nasdaq’s behavior, company growth rates, & profitability. The underlying business must have some base value which is the where the market has cleared these transactions. Software companies growing between 10-35% trade at 5-13x forward revenues.

I can’t ascertain how record fundraising inflows into private equity funds might bolster these prices, but the billions burning holes in PE wallets must impel some activity.

As 2022 concludes, transactions like these will inform late-stage venture prices. These figures will fill the comparables sections of investment memos.